U.S. to Ban Goods Made In Xinjiang, China

Under a new law, the U.S. will ban imports of all goods made in whole or in part from any good from the Xinjiang Uyghur Autonomous Region in China, effective June 21, 2022. Companies need to use the next 180 days to ensure their supply chains do not include such goods.

Sandler, Travis & Rosenberg, P.A., has developed a program to help companies review their supply chain visibility in response to this new law.

For more information on this program, please contact Elise Shibles (at (415) 490-1403 or via email eshibles@strtrade.com), Amanda Levitt (at (212) 549-0148) or via email alevitt@strtrade.com), or David Olave (at (202) 730-4960 or via email dolave@strtrade.com).

BOC NOTE: Xinjiang should not be confused with the common coastal port named Xingang (Tianjin). Xinjiang is 2,000 miles inland from Xingang/Tianjin/Yellow Sea.

LA/LB Port Update- New Fee

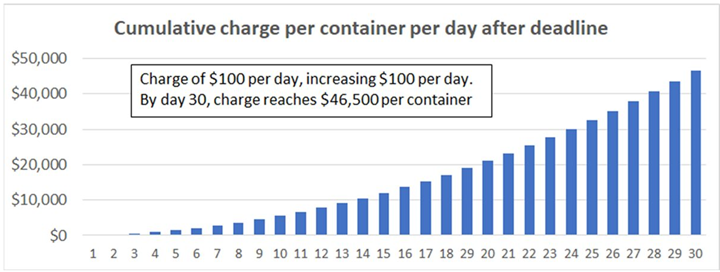

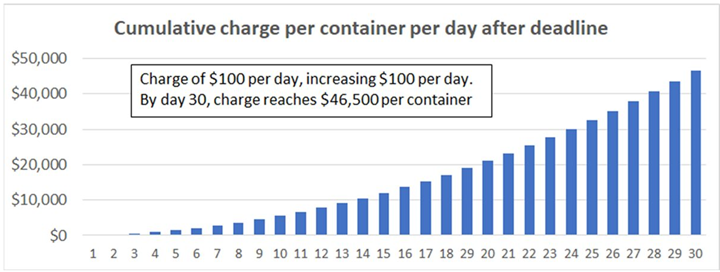

The details are being finalized but the current plan is for the terminal to bill the ocean carrier. In the end, the ocean carrier will likely bill the cost to the importer directly or increase the ocean freight to cover the fees. Similar to demurrage, detention, excess chassis fees and now these new charges, everything is getting dumped on the importer. It is unfair but it is what is currently happening in the marketplace.

Until the world governments can step up or until the advantage goes back to the importer when the demand is not so strong, the carrier and terminal will continue to be king and put everything back on the importer. We are suggesting for all importers to contact your congressional representatives and voice your concern.

Chart: American Shipper

BOC will continue to monitor this situation and will advise if there are any changes or updates. If you have any questions please feel free to reach out to your BOC representative.

Finally Some Good News for Importers

(Tariff Exclusions)

USTR will start a targeted tariff exclusion process focused on restating previously extended exclusions, most of which expired on December 31, 2020. Per a Federal Register notice inviting public comment attached, USTR will evaluate the reinstatement of each of these exclusions on a case-by-case basis. The 549 exclusions covered by the notice can be found in the link below:

For additional information on 301 tariffs, please visit the below link of Sandler, Travis and Rosenberg, PA, or contact their attorney who specializes in this area, Paula Connelly.

https://www.strtrade.com/trade-news-resources/tariff-actions-resources/section-301-tariffs-on-china

Paula Connelly, Esquire

mobile phone: (781) 897-1771

pconnelly@strtrade.com

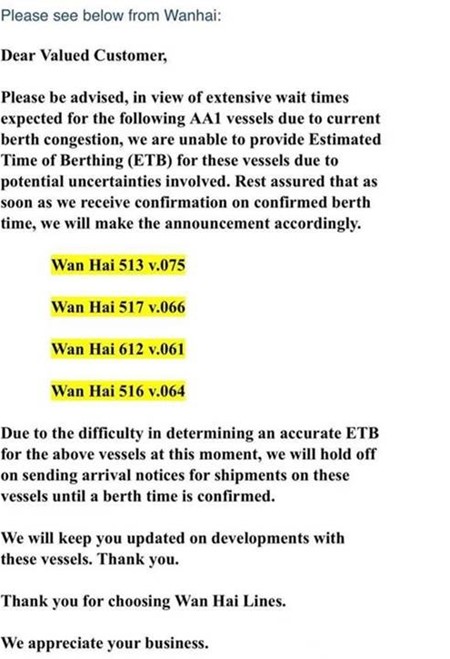

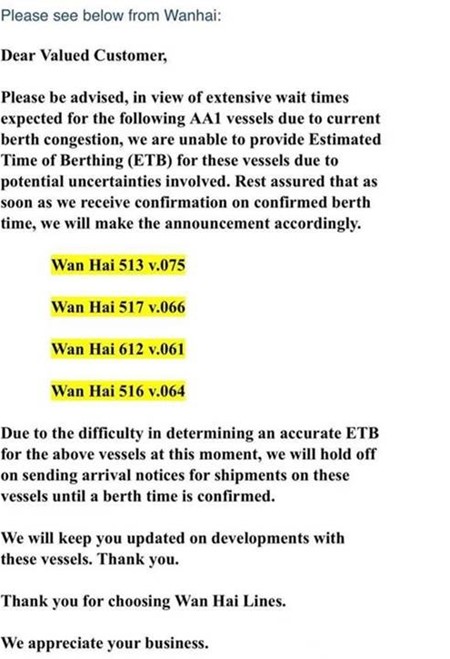

NOTICE OF CHB DELAYS DUE TO UNCERTAIN BERTHING TIMES/LOCATIONS

All steamship lines are experiencing port and berth congestion. Please see notice below received from Wanhai. This explains the late notice brokers are receiving regarding arrival notices, berthing times and locations. Without an accurate arrival notice, Customs Brokers cannot file Customs entry. Please be patient as we all continue to work through these trying times. Rest assured, our CHB teams want to clear your freight as quickly as possible.

Asia Holidays

Key Asian locations with upcoming holidays, listed below.

China Schedule for Upcoming holidays.

| Sep 18 | Saturday | Special Working Day | Working day on weekend |

| Sep 19 | Sunday | Mid-Autumn Festival holiday | National holiday |

| Sep 20 | Monday | Mid-Autumn Festival holiday | National holiday |

| Sep 21 | Tuesday | Mid-Autumn Festival | National holiday |

| Sep 26 | Sunday | Special Working Day | Working day on weekend |

| Oct 1 | Friday | National Day | National holiday |

| Oct 2 | Saturday | National Day Golden Week holiday | National holiday |

| Oct 3 | Sunday | National Day Golden Week holiday | National holiday |

| Oct 4 | Monday | National Day Golden Week holiday | National holiday |

| Oct 5 | Tuesday | National Day Golden Week holiday | National holiday |

| Oct 6 | Wednesday | National Day Golden Week holiday | National holiday |

| Oct 7 | Thursday | National Day Golden Week holiday | National holiday |

| Oct 9 | Saturday | Special Working Day | Working day on weekend |

Taiwan Schedule for Upcoming holidays

| Sep 20 | Monday | Mid-Autumn Festival | National holiday |

| Sep 21 | Tuesday | Mid-Autumn Festival | National holiday |

| Oct 10 | Sunday | National Day | National holiday |

| Oct 11 | Monday | National Day observed | National holiday |

Thailand Schedule for Upcoming holidays

| Sep 24 | Friday | Mahidol Day | National holiday |

| Oct 13 | Wednesday | Anniversary of the Death of King Bhumibol | National holiday |

Malaysia Schedule for Upcoming holidays

| Oct 2 | Saturday | Birthday of the Governor of Sabah | State Holiday | Sabah |

| Oct 9 | Saturday | Birthday of the Governor of Sarawak | State Holiday | Sarawak |

Indonesia Schedule for Upcoming holidays

| Oct 7 | Thursday | Navaratri | Hindu Holiday |

| Oct 15 | Friday | Dussehra | Hindu Holiday |

| Oct 20 | Wednesday | Maulid Nabi Muhammad (The Prophet Muhammad’s Birthday) | Public Holiday |

Japan Schedule for Upcoming holidays

| Sep 20 | Monday | Respect for the Aged Day | National holiday |

| Sep 23 | Thursday | Autumn Equinox | National holiday |

India Schedule for Upcoming holidays

| Oct 2 | Saturday | Mahatma Gandhi Jayanti | Gazetted Holiday |

| Oct 7 | Thursday | First Day of Sharad Navratri | Observance, Hinduism |

| Oct 11 | Monday | First Day of Durga Puja Festivities | Observance, Hinduism |

| Oct 12 | Tuesday | Maha Saptami | Restricted Holiday |

| Oct 13 | Wednesday | Maha Ashtami | Restricted Holiday |

| Oct 14 | Thursday | Maha Navami | Restricted Holiday |

| Oct 15 | Friday | Dussehra | Gazetted Holiday |

| Oct 19 | Tuesday | Milad un-Nabi/Id-e-Milad (Tentative Date) | Gazetted Holiday |

| Oct 20 | Wednesday | Maharishi Valmiki Jayanti | Restricted Holiday |

Ships resume docking at Ningbo port after two-week shutdown

Berthing operations have resumed at the Port of Ningbo-Zhoushan after having been suspended for two weeks. CMA CGM reports that two of its vessels were in the process of completing cargo operations.

Ships have resumed berthing operations at a halted container terminal in Ningbo, China, adding to optimism that full activity at one of the world’s busiest ports will be restored shortly after a two-week shutdown to quarantine dockworkers.

| Photo: Stringer/Reuters/Ritzau Scanpix BY ANN KOH, BLOOMBERG excerpted from Yahoo.com |

At least five container ships have left the Meishan terminal at Ningbo in the past few days after berthing there, according to shipping data compiled by Bloomberg. While container collection services were still halted on Tuesday, some ships have been allowed to berth at the terminal, an official from the Ningbo-Zhoushan port said.

The movement of ships is sparking optimism among shippers that operations will resume soon after no new cases of Covid-19 were discovered, according to local media reports.

The Meishan terminal has resumed partial vessel operations since Aug. 18 and is expected to have a gradual return to full operations in the coming weeks, shipping line CMA CGM SA said in an advisory to customers.

Two of the company’s ships – the Rivoli and the Samson – were completing cargo operations and would depart the terminal “very soon,” the French company said on Aug. 20. The ships have since left Ningbo, while a separate vessel named the Taurus traveled to Meishan on Sunday and is currently docked there, Bloomberg data showed.

CMA’s Elbe arrived at the terminal on Monday after waiting at anchorage for a week.

The Meishan terminal, which accounts for about a quarter of the Ningbo port’s container throughput, was shut on August 11 after a worker became infected with the delta variant of Covid-19. The partial closure of the world’s third-busiest container port worsened congestion at other major Chinese gateways such as Shanghai, Xiamen and Hong Hong, as ships diverted away amid uncertainty over how long virus control measures in the city will last

2.7 million containers queued off the world’s

ports – Ningbo shutdown worsens bottlenecks

Traffic pressure in the world’s largest container ports is now so intense that 2.7 million twenty-foot containers are waiting off ports to unload their goods. Some ships have been waiting for 18 days, shows an analysis from VesselsValue, and the Ningbo shutdown has only exacerbated the problem.

| BY DAG HOLMSTAD, excerpted from ShippingWatch.com |

It may prove difficult for the US and many other countries to stock up enough retail goods for the shopping spree that awaits on Black Friday and during the Christmas season.

As a consequence of the traffic pressure in the world’s largest container ports, 2.7 million twenty-foot containers are currently anchored off some of the world’s largest container ports.

More specifically, 409 container vessels loaded with a total of 2,732,133 twenty-foot containers (teu) filled with goods for retail and industry are currently waiting in line to unload their cargo, according to a new analysis prepared by VesselsValue for ShippingWatch.

Over the past nine days, the shut down container terminal Meishan in major Chinese port Ningbo has only exacerbated the chaos in global supply chains.

Thousands of containers waiting

As of August 18, a total of 80 container vessels comprising 393,650 teu are waiting to unload and reload goods at Ningbo’s remaining terminals, according to VesselsValue.

Marking the longest waiting period, one container vessel has been in line for more than nine days.

In another major Chinese port, Zhoushan, 100 container vessels totaling 457,869 teu are awaiting permission and entry at the terminals to unload their goods, with the longest waiting period being more than five days.

On the US west coast at Long Beach, California, one of the largest container ports in the US, issues with queues and bottlenecks are major as well, shows the analysis from VesselsValue.

33 container vessels are queued outside the port, totaling 255,333 teu, with one container vessel waiting for more than 18 days.

Good and bad news

According to shipping analyst Lars Jensen at Vespucci Maritime, there are both good and bad news about the precarious situation in global supply chains.

The good news, according to Jensen, is that the Meishan terminal at Ningbo, which was shut down on August 11, has now reopened.

The news about a reopening have yet to be confirmed, however, both by Chinese authorities as well as the carriers.

The bad news, on the other hand, is that even though the remaining terminals have been able to somewhat manage the daily container traffic of around 77,000 teu, corresponding to 90 percent of the flow, the delays and rerouting that ensued from the shutdown will continue to reverberate throughout other ports and continually cause congestion in the global supply chains, Jensen explains.

The current situation resulting from the Ningbo shutdown will continually generate challenges in coming weeks. The overall situation, however, is not as bad as expected compared to the partial shutdown of Yantian, China, earlier in the year, Jensen concludes.

China bulker pileup dwarfs California container-ship gridlock

COVID restrictions in China push dry bulk congestion to all-time high

excerpted from Freightwaves.com – Greg Miller, Senior Editor

Container ships stuck off Los Angeles/Long Beach are grabbing the headlines — with a record-tying 40 at anchor on Friday. But there’s another massive shipping traffic jam out there, one that’s holding up even more cargo.

This other, less-publicized tale of seaborne gridlock is set in China and it’s not about container ships, it’s about dry bulk carriers.

| Idle bulk carriers off the coast of China and in the Yangtze River on Friday (Map: MarineTraffic) |

Bulker congestion has now risen to historic highs as China enforces stricter COVID rules for arriving vessels. And what happens in China will be felt in America. Every bulker

stuck at anchor in China is one less ship that’s available to load U.S. soybeans, corn, wheat and coal — pushing spot freight rates for U.S. bulk exports higher.

“It is staggering how much congestion there is [in China],” said Martyn Wade, CEO of Grindrod Shipping (NASDAQ: GRIN), on a conference call with analysts on Thursday.

Highest congestion on record

According to Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, there were 1,692 bulkers worldwide . . . waiting in queues in mid-August, equating to 15.9% of global capacity. That was “the highest level we have on record and about 15% higher year on year,” he said. In comparison, U.K.-based data provider VesselsValue reported that there are 409 container ships stuck in congestion worldwide with an aggregate capacity of 2.7 million twenty-foot equivalent units. Not only are there far more bulkers tied up than box ships, but a typical bulk vessel carries much more cargo (measured by weight) than the average container ship.

China is driving the rise in global dry bulk congestion, comprising more than a third of the total, said Ristic. Bulker congestion in China hit 52.7 million DWT in mid-August, representing 6% of global capacity, up 28% from mid-July and 23% year on year. Bulker congestion was also high outside of China, but in line with seasonal norms.

(Charts: Braemar ACM Shipbroking)

U.K.-based forecasting and advisory company Maritime Strategies International (MSI) highlighted the same trend. In its latest sector outlook, it cited data from Oceanbolt showing 405 bulkers waiting outside Chinese ports on Aug. 12 for more than five days, compared to 261 on the same day last year and 113 on that day in 2019, pre-pandemic.

The flashpoint in China is the Yangtze River region. Ristic said it accounts for “about 18% of total bulker congestion in China and it has become a particularly bad bottleneck for geared vessels [bunkers with onboard cranes].”

COVID rules keep bulkers at bay

Congestion in container shipping is primarily caused by COVID-era changes in consumer spending, whereas congestion in dry bulk shipping is primarily caused by COVID precautions at ports.

COVID rules have caused bulker delays throughout the year, but this month’s delta variant outbreak in China brought restrictions to a whole new level.

“We’ve heard reports that on the Yangtze, they’re talking about all river pilots having to do compulsory quarantine,” said Wade.

According to Ristic, “Regardless of how long vessels have been at sea since their last port call, their risk level is reportedly being assessed by authorities based on factors such as crew nationality and boarding time, navigation route, and cargo on board. On top of this, quarantine measures have greatly reduced the number of pilots operating on the river, which has been slashed up to 50% versus normal levels.

“At other ports, we are hearing reports of mandatory quarantine periods, cargo operations not being allowed to proceed until negative PCR test results are obtained and other protocols,” added Ristic.

According to Argus Media, “Many Chinese coastal ports require a 14-day quarantine for imported cargoes after they depart from ports in other countries — including Indonesia, India and Laos — before they can berth. Some other Chinese ports, including Nanjing and Changshu along the Yangtze River, require a 21-day quarantine. The Liuheng terminal at east China’s Zhoushan port requires a quarantine as long as 28 days. All crew members must take COVID-19 test before vessels are allowed to discharge their cargoes.”

DOT Brake Safety Week

Expect fewer trucks on the road, more delays and increased costs

Brake Safety Week Set for Aug. 22-28

This year’s Brake Safety Week is scheduled for Aug. 22-28. During Brake Safety Week, commercial motor vehicle inspectors emphasize the importance of brake systems by conducting inspections and removing commercial motor vehicles found to have brake-related out-of-service violations from our roadways. At the same time, many motor carriers work to educate their drivers and maintenance service providers on the importance of brake system safety.

Throughout the week, inspectors will conduct North American Standard Inspections of commercial motor vehicles, focusing on the vehicle’s brake systems and components. In addition, inspectors will compile data on brake hoses/tubing, the focus area for this year’s Brake Safety Week, to submit to the Commercial Vehicle Safety Alliance (CVSA). CVSA will report its findings later this year.

Jurisdictions devote a week to conducting commercial motor vehicle inspections, identifying brake violations and removing vehicles with out-of-service brake violations because:

Brake system and brake adjustment violations accounted for more vehicle violations than any other vehicle violation category, accounting for 38.6% of all vehicle out-of-service conditions, during last year’s three-day International Roadcheck inspection and enforcement initiative.

“Brake system” was the third most cited vehicle-related factor in fatal commercial motor vehicle and passenger vehicle crashes, according to the Federal Motor Carrier Safety Administration’s (FMCSA) latest “Large Truck and Bus Crash Facts” report.

Brake-related violations accounted for eight out of the top 20 vehicle violations in 2020, according to FMCSA’s Motor Carrier Management Information System.

During last year’s Brake Safety Week, 12% of the 43,565 commercial motor vehicles inspected were placed out of service for brake-related violations.

The dates for Brake Safety Week are shared in advance to remind motor carriers, drivers and commercial motor vehicle mechanics/technicians to proactively check and service their vehicles to ensure every commercial motor vehicle traveling on our roadways is safe, mechanically fit and compliant. Recent research has shown that announcing enforcement campaigns ahead of time improves overall compliance better than surprise enforcement campaigns and for longer periods after the event.

August, the month of CVSA’s Brake Safety Week, is also Brake Safety Awareness Month. Law enforcement agencies will work to educate commercial motor vehicle drivers, motor carriers, mechanics, owner-operators and others on the importance of proper brake maintenance, operation and performance through outreach, education and awareness campaigns.

Source cvsa.org

New COVID Procedures at Shanghai (PVG) Airport

Please be advised that Shanghai Pudong International Airport (PVG) has implemented new COVID-19 measures, as below:

Under the new 7+7+7 or 14+7+7 measures, terminal workers at PVG are required to:

- work 7 or 14 days in the terminal

- complete a 7-day quarantine in a hotel

- complete another 7-day quarantine at home

This arrangement is expected to cause a shortage in manpower that may result in the following:

- Frequent short- or off-loading

- Shortage of staffing

- Longer terminal handling time

- More flight cancellations and shortage of import and export capacity

- Increase in airfreight rates

- Some suspension of trucking, causing major backlogs

- Embargoes for seafood and perishable items

- Screening and disinfecting of some freight

BOC will continue to monitor and advise, as these requirements and restrictions change.

China-U.S. container shipping rates sail past $20,000 to record

By Roslan Khasawneh and Muyu Xu of Reuters

SINGAPORE/BEIJING (Reuters) – Container shipping rates from China to the United States have scaled fresh highs well above $20,000 per 40-foot box as rising retailer orders ahead of the peak U.S. shopping season add strain to global supply chains. The acceleration in Delta-variant COVID-19 outbreaks in several counties has slowed global container turnaround rates. Typhoons off China’s busy southern coast in late July and this week have also contributed to the crisis gripping the world’s most important method for moving everything from gym equipment and furniture to car parts and electronics.”These factors have turned global container shipping into a highly disrupted, under-supplied seller’s market, in which shipping companies can charge four to ten times the normal price to move cargoes,” Philip Damas, Managing Director at maritime consultancy firm Drewry, said. “We have not seen this in shipping for more than 30 years,” he said, adding he expected the “extreme rates” to last until Chinese New Year in 2022.

RATE HIKES

The spot price per container on the China-U.S. East coast route – one of the world’s busiest container lanes – has climbed over 500% from a year ago to $20,804 this week, freight-tracking firm Freightos said. The cost from China to the U.S. west coast is a little below $20,000, while the latest China-Europe rate is nearly $14,000, Freightos’ data shows. Ding Li, president of China’s port association, told Reuters the spike followed a rebound in COVID-19 cases in other countries, which has slowed turnover at some major foreign ports to around 7-8 days. The surging container rates have fed through to higher charter rates for container vessels, which has forced shipping firms to prioritise service on the most lucrative routes. “Ships can only be profitably operated in the trades where freight rates are higher, and that is why capacity is shifting mostly to the U.S.,” said Tan Hua Joo, executive consultant at research consultancy Alphaliner. Some shippers have reduced volumes in less profitable routes, such as the transatlantic and intra-Asia, said Damas. “This means that rates on the latter are now increasing fast.”

NO RESPITE

The rate surge is the latest reflection of disruptions since COVID-19 slammed the brakes on the global economy in early 2020 and triggered huge changes to the flows of goods and healthcare equipment around the world. “Every time you think you’ve come to an equilibrium, something happens that allows shipping lines to increase the price,” said Jason Chiang, Director at Ocean Shipping Consultants, noting the Suez canal blockage https://www.reuters.com/world/asia-pacific/how-giant-container-ship-is-blocking-suez-canal-2021-03-25 in March had played a major role in allowing firms to hike rates. “There are new orders for shipping capacity, equal to almost 20% of existing capacity, but they will only come online in 2023, so we will not see any serious increase in supply for two years,” Chiang added.

(Reporting by Roslan Khasawneh in Singapore and Muyu Xu in Beijing. Editing by Gavin Maguire and Barbara Lewis)

Severe Limitations on Intermodal Freight moving to Inland USA Points

Most steamship lines have severely limited the intermodal freight they will accept, to move from the US Coasts to Inland Interior US points.

• ONE is now nearly completely stopping IPI bookings.

• OOCL/CMA-CGM stopped accepting most IPI bookings.

• HMM/Yang Ming/Cosco, and Evergreen, have stopped taking almost all IPI bookings.

• MSC is still accepting some bookings, but has increased the inland fee significantly, when they

do accept a booking.

Most steamship lines have not issued formal letters like ONE has; they simply are refusing to take these bookings.

BOC Customer Advisory

Transpacific faces challenges impacting all of supply chain

Dear Valued Customers,

With this advisory, BOC aims to provide you as our valued customer with the most relevant and up-to-date information to help you navigate this period of heightened volatility.

Key Notes:

- Shanghai and Yantian port operations are starting to experience increased congestion challenges as peak season volume pressure ramps up. Both ports are now experiencing 5-6-day delays on average.

- Equipment Availability in Asia is now at critical levels in several locations with the situation being most dire in both Vietnam and Indonesia, while South China also remains stressed. In Vietnam, the ongoing congestion challenges in Vung Tau it set to deteriorate even further as the region sees a spike in COVID-19 cases. With further lockdowns now introduced, this could very well be the source of the next major supply chain disruption headline in the coming days.

- Ports of Los Angeles and Long Beach improving but still heavily congested. We have 10-15 vessels at anchorage awaiting a berth. All large vessels are limited to 4 gangs and are experiencing extended port stays by on average 3-4 days.

- Port of Oakland vessel wait times have improved to an average of 7-10 days. The heavy congestion, however, has forced shipping lines to limit or omit their scheduled calls. All vessels have been limited to 2 gangs per shift due to continued labor constraints in meeting the high-volume demand.

- Port Yard Utilization at Seattle remains at capacity (120%), with labor restrictions also kept in place pending yard availability improvements. In Prince Rupert, the situation remains pressed with yard operations at 106% to capacity while in Vancouver, the situation is expected to deteriorate over the coming days due to the rail service disruptions brought on by the Lytton wildfires in Canada.

- Truck Capacity and Chassis Availability are in short supply across select locations. The situation is most critical across the Mid-West, Southeast, and Newark.

Trending Themes:

Yantian Terminal Operations Recovery at a Tipping Point

The situation in Yantian continues to improve with terminal operations slowly returning to normal levels, but as peak volume flows begin to ramp up, the recovery may well be put to test. Vessel wait times that had recovered to within a day have now crept back up to the 5-6-day range. While yard density remains at manageable levels, the challenge from here is largely centered around the clearance of what can only be described as a significant backlog of cargo sitting at customer’s facilities or on factory floors.

There are three factors at play that need to come together in order to resolve the issue. The first and likely most pressing is in the availability of equipment. As many vessels were forced to omit the port during the peak of the COVID outbreak, opportunities to reposition empties into the area were as a result limited. Today we are seeing a shortage of 40’/40HC/45’ in South China. While we are actively working on repositioning containers into the area, customers are asked to where possible substitute their equipment with 20’ containers to alleviate the pressure. The second factor is in the available carrier capacity. While the possibility of introducing additional vessels into the network remains limited, as an alternative we are instead over-allocating space to Yantian cargo on existing vessel calls to help clear the backlog. The final piece to the puzzle is dependent on the continued normalization of operations at the South China ports. Daily truck quotas for laden container return continue to increase but with vessel wait times once again creeping up, this poses a serious risk to the overall recovery.

Empty Equipment Stock in North America is Rising Once Again

The container equipment stock status across North America continues to ebb and flow as supply chain disruptions make repositioning efforts incredibly complex and challenging. While the initial drop in volume brought on by the Yantian disruption had allowed the teams the opportunity to clear out some of the excess stock, the slide sailings that followed had the opposite effect as empties sat awaiting vessel arrivals for repositioning back to Asia. Now with the peak surge, severe congestion in select areas are contributing to slower empty returns. This is not only hurting exporters as chassis availability becomes limited but it’s also causing vessels to return to light or underutilized thus exacerbating the equipment shortage in Asia.

To help combat this shortage we have introduced both Extra Loaders and Gap Loaders to help normalize the network and to move surplus empties back to Asia. Our success is still heavily dependent on customer’s support in turning empty containers back as quickly as possible, particularly in the Pacific Southwest where the situation is most pressed. Also, worth noting as the Wildfires in British Columbia persists, given the dangers, rail providers are prioritizing containment operations rather than container movement. As a result, we expect to see equipment shortages across the West Coast with inland stocks set to rise in the coming weeks.

Trucking Capacity Continues to Tighten in Select Locations

Truck capacity and chassis availability remain a major concern in several locations across North America. The primary challenge in the Northeast is in the limited availability of chassis in the Newark area due to an increase in cargo dwell time. In the Gulf area, Dallas is experiencing reduced truck capacity for long-haul moves while Houston is struggling with both truck and chassis availability. This continues to impact imports departing from Bayport, Barbours CT, and BNSF Pearland as well as exports originating in Houston and West Texas. Mobile and New Orleans are also experiencing reduced truck capacity, with some providers now fully booked through to the end of July.

In the South Atlantic, volumes in Memphis is once again surging, the I-40 bridge closure is still causing capacity issues into west Memphis as drivers are either declining the load or charging a premium for doing so. The bridge is still on schedule to be opened by end of July. In Atlanta, the chassis shortage continues to cause major delays for import rail cargo out of Fairburn. While in the Midwest area we are seeing chassis shortages across the region. As cargo dwell time continues to rise, it is proving to be extremely difficult to source truck or chassis capacity for exports out of Chicago.