Overall Market Update – Including Details on the Increasing Threat of October 1 ILA Labor Strike

Asia to USA Cargo volume is still strong, and we believe it will maintain a robust pace until CNY (January 29, 2024) because of the following reasons:

1. Consumer confidence is becoming stronger

2. A rate cut by the Fed is likely in September

3. Stock Market repeatedly hitting all-time highs

4. With the potential for a second term for Donald Trump, there is the possibility of higher tariffs beginning in 2025. Importers are gearing up to bring in product in advance of these potential increases.

5. ILA President Harold Daggett says the threat of the October 1st Strike at US Atlantic and Gulf Ports is growing more likely. Cargo will be pushed to be front-loaded as much as possible to compensate for potential delays in cargo arrival. Please see the article below from the ILA’s website.

We note that additional capacity has been added to the USWC, which is helping relieve some of the cargo pressure, but the overwhelming cargo surge is still overpowering the market. Please reach out to your BOC representative to help facilitate the movement of your cargo. Thank you for all your support.

https://ilaunion.org/2024/07/ila-president-harold-daggett-says-threat-of-october-1st-strike-at-atlantic-and- gulf-coast-ports-growing-more-likely/)

ILA President Harold Daggett Says Threat of October 1st Strike At Atlantic and Gulf Coast Ports Growing More Likely

JULY 12, 2024

NORTH BERGEN, NJ – (July 12, 2024) The leader of the International Longshoremen’s Association says the threat of a strike at all Atlantic and Gulf Coast Ports is becoming more likely as time is growing short before the current contract expires in 80 days, on September 30, 2024. Harold J. Daggett, ILA President and the union’s Chief Negotiator, said that the employers represented by United States Maritime Alliance (USMX) are running out of time to negotiate a new Master Contract agreement and avoid and coastwide strike on October 1, 2024.

“Only 80 days remain before the end of our current contract and we are waiting on USMX,” said ILA President Daggett. “The actions of violating our current Master Contract by some of their members caused us to cancel scheduled negotiations with USMX in early June.”

The ILA canceled Master Contract talks with USMX after discovering that APM Terminals and Maersk Line were utilizing an Auto Gate system, which autonomously processes trucks without ILA labor. This system, initially identified at the Port of Mobile, Alabama, is reportedly being used in other ports as well.

The ILA said on June 10, 2024, that it would not meet with USMX until the Auto Gate issue is resolved. Additionally, the union is still waiting on results from an audit for jobs created out of new technology, a report they have been anticipating for almost two contract periods. The ILA has observed an increasing number of IT personnel on marine terminals, with concerns that APM and Maersk’s IT departments in Charlotte, North Carolina, are encroaching on their jurisdiction.

President Daggett said the ILA rank-and-file members are 100 percent behind him and are willing the “hit the streets” on October 1, 2024, if the union’s contract demands are not met.

“We will not entertain any discussions about extending the current contract, nor are we interested in any help from outside agencies to interfere in our negotiations with USMX,” said President Daggett. “This includes the Biden Administration and the Department of Labor.”

Whenever USMX resumes negotiations, the ILA said it expects shipping companies to recognize the contributions ILA longshore workers made during the pandemic, when ports remained open, allowing companies to record billion-dollar profits.

About the International Longshoremen’s Association:

The International Longshoremen’s Association (ILA) is the largest union of maritime workers in North America, representing 85,000 longshore workers along the East Coast, Gulf Coast, Puerto Rico, Great Lakes, and major U.S. rivers. Its membership includes longshore workers in Eastern Canada and the Bahamas. The ILA is dedicated to ensuring fair labor practices and protecting the rights and jobs of its members.

Breaking News: ILA Halts Negotiations with USMX Amid Automation Disputes

Via: https://ilaunion.org/2024/06/ila-halts-negotiations-with-usmx-amid-automation-disputes/

Labor negotiations have taken a turn for the worse. Please see the article below from the ILA website. The increased risk of a strike will likely accelerate US companies to bring in and ship out more goods as soon as possible because of the greater possibility of coming US port slowdowns and shutdowns. Please see your BOC representative for guidance and support.

JUNE 10, 2024

International Longshoremen’s Association (ILA) Halts Negotiations with United States Maritime Alliance (USMX) Amid Automation Disputes

North Bergen, NJ – (June 10, 2024) The International Longshoremen’s Association (ILA) today announced the suspension of talks with the United States Maritime Alliance (USMX) scheduled for Tuesday, June 11, 2024. This decision arises amidst ongoing negotiations of local agreements under the coast-wide Master Contract, set to expire on September 30, 2024.

The ILA canceled Master Contract talks with USMX after discovering that APM Terminals and Maersk Line are utilizing an Auto Gate system, which autonomously processes trucks without ILA labor. This system, initially identified at the Port of Mobile, Alabama, is reportedly being used in other ports as well. A spokesperson for the ILA stated, “Here we go again! This is another example of USMX members unilaterally circumventing our coast-wide Master Contract. This is a clear violation of our agreement with USMX, and we will not tolerate it any longer.”

“There’s no point trying to negotiate a new agreement with USMX when one of its major companies continues to violate our current agreement with the sole aim of eliminating ILA jobs through automation,” said International President Harold J. Daggett, who serves as chief negotiator for the union.

The ILA will not meet with USMX until the Auto Gate issue is resolved. Additionally, the union is still waiting on results from an audit for the jobs created out of new technology, a report they have been anticipating for almost two contract periods. The ILA has observed an increasing number of IT personnel on marine terminals, with concerns that APM and Maersk’s IT departments in Charlotte, North Carolina, are encroaching on their jurisdiction.

“We are not taking this lightly,” the ILA cautioned.

The ILA is monitoring and keenly aware of APM Terminals and Maersk Line’s repeated attempts to circumvent the ILA-USMX Master Contract and cut ILA jobs through the introduction of automation and semi-automation equipment.

“Most of the problems the ILA is facing on the East and Gulf Coast all stem from APM Terminals and Maersk Line,” the ILA added. “Maersk Line, the second largest ocean carrier in the world, has a track record of pushing automation. They started semi-automation in the Port of Hampton Roads, and have full automation at Pier 400 in Los Angeles, California. The ILA lost tens of thousands of jobs in the 1970s due to containerization, and APM and Maersk seem to be leading the charge to eliminate good, family-sustaining jobs right here in the U.S.”

The ILA has long expressed deep concern over the impact of automation on jobs, highlighting APM Terminals and Maersk Line’s abuse of the ILA Master Contract, which have led to job losses in various ports.

ILA President Daggett made it clear that the union will take a firm stance against any technology that threatens ILA jobs. He spoke extensively at the union’s quadrennial convention last summer, about Maersk Line’s history of pushing automation down the throats of workers around the world.

“Who the hell is a foreign company like Maersk, to come on to American soil and build fully automated terminals,” the ILA leader asked in a fiery speech to hundreds of ILA delegates at that July 2023 Convention. “This foreign company Maersk tries to shove fully automated terminals down our throats and for what reason? To eliminate good paying American jobs, ILA jobs.”

The ILA leader expressed criticism of President Joe Biden and lawmakers for turning a blind eye to automation and its devastating effect on American workers.

“How can this Administration allow a foreign company like Maersk, and other foreign shipping companies, to get away with this?” President Daggett asked in his convention remarks, as he warned Maersk and other foreign companies of the consequences of their plans to automate. “Mark my words, there is going to be a

n explosion, and the ILA and dockers around the world are going to light the fuse.”

His son, Dennis A. Daggett, who serves as the ILA’s Executive Vice President, echoed these sentiments in his own convention remarks, as he stated that the relationship with USMX is not as it appears.

“We want ironclad language and the actual intent of that language in writing,” he told ILA convention delegates last July. “Years after we sign a contract, everyone seems to get amnesia.”

Today as the ILA announced cancelation of talks with management, ILA Executive Vice President Daggett said: “I guess they (USMX) just thought our speeches at the convention were for show. Well, I hope they realize by now that every word spoken was real and sincere.”

The ILA is now putting action behind those words as it cancels talks with USMX.

The ILA believes there are many issues that need to be resolved in their current agreement before they resume negotiations. With less than four months until the contract’s expiration, the ILA has very little faith that these issues will be addressed in time. “Historically, management has been known to drag their feet or kick the can down the road, but I think this time it caught up with them.”

The ILA continues to call on the Administration and President Biden to recognize the threat posed by foreign-owned companies attempting to undermine American jobs. “We won’t stand for it, and neither should they,” the spokesperson concluded.

About the International Longshoremen’s Association

The International Longshoremen’s Association (ILA) is the largest union of maritime workers in North America, representing 85,000 longshore workers along the East Coast, Gulf Coast, Puerto Rico, Great Lakes, and major U.S. rivers. Its membership includes longshore workers in Eastern Canada and the Bahamas. The ILA is dedicated to ensuring fair labor practices and protecting the rights and jobs of its members.

A COVID Shipping Environment Without COVID

There is a massive escalation in the pricing of spot rates at a pace like the one we experienced during the COVID-19 pandemic. Every two weeks for the past two months, we have seen successful rate increases in the spot market as high as $1,000 or more each time, depending on port pairs. We expect the trend to continue for at least the next 30 days, with GRIs and PSSs on June 1st and June 15th forecasted to exceed $2,000 of additional rate increases by the end of June.

What is causing these increases?

Less Supply and More Demand

Here are some supply and demand factors that demonstrate what creates this challenging environment.

Less Supply

- The ocean carriers are cutting space and creating high demand to earn more profit by reducing the supply. Trans-Pacific capacity into the West Coast has seen a reduction versus plan of some 14%, whereas the trade into the East Coast has seen a reduction of 11%. These “blank/canceled” sailings are the number 1 factor driving increased prices. The additional capacity that was supposed to be added is not happening at the pace as promised. The exact opposite occurs with these space reduction actions, which cut supply.

- The geopolitical unrest has practically closed the Suez Canal for container vessels, taking capacity out of the system and reducing the supply.

- The lack of water in the Panama Canal and construction in the Canal has limited the number and weight of vessels transiting the Canal. This restrictive activity has been improving due to recent rain in Panama, but it is still not back to normal capacity.

- The threat of labor strikes at the Canadian Rails and Canadian Ports has caused diversions and congestion as shippers try to avoid Canadian routings whenever possible. This congestion increases the supply problem as cargo bunches at ports and rails.

- There is also a growing problem of a supply shortage of empty containers in Asia due to the slow return of empties due to the longer transit times and reduced stops to pick up empties when going around the Cape of Good Hope. A container shortage adds to the pressure and increases prices as shippers compete for empties to load their products.

More Demand

- The “hoarding of toilet paper factor” is kicking in again in our shipping world. Buyers are seeing delays, rushing to place orders earlier, and making them larger. The calm, slow replenishing process that was going on at the beginning of the year is now a mad scramble to get as many goods in as possible as soon as possible. It is clear that shippers fear there will be a squeeze on capacity during the peak season in Q3 then they will start importing more goods now.

- Container volumes are forecasted to be up 10-20% for the first six months of 2024 vs 2023, as noted by various indexes creating more demand than expected.

- The threat of labor demonstrations/strikes at the US East Coast Ports, whose longshore union workers contracts expire in September, has pushed shippers to ship sooner to prepare for work slowdowns and disruption.

We recommend booking cargo as far in advance as possible and preparing for delays in moving cargo. We see many origins booked 2-3 weeks in advance. After talking to many experts, no one has convinced us of a firm date for things to return to “normal,” but we expect that most agree; this will continue through the end of July.

Please reach out to your BOC representative to help guide you through this crisis. Thank you for all your support.

Further China Tariff Increases Likely

A mandatory review of the Section 301 tariffs on imports from China concluded May 14 with recommendations to increase some tariffs on $18 billion worth of Chinese goods, establish an exclusion process for a limited number of products, and make other changes.

A Federal Register notice soliciting comments on the proposed changes is expected next week.

The recommendations are included in the Office of the U.S. Trade Representative’s report on its review of the tariffs, which were first imposed in 2018 in an effort to persuade China to modify its “harmful technology transfer-related acts, policies, and practices.”

USTR Katherine Tai said that while the tariffs have been somewhat successful in that regard, “further action is required.”

USTR also downplayed the impact of the tariffs on U.S. businesses, saying they have had small negative effects on U.S. economic welfare, prices, and employment and that these impacts are “particularly associated” with China’s retaliatory tariffs on U.S. exports.

In fact, USTR asserted, the tariffs have helped to increase U.S. production in the most-affected industrial sectors, reduce imports from China, and increase imports from alternate sources, “thereby potentially supporting U.S. supply chain diversification and resilience.”

USTR is therefore proposing to maintain all existing Section 301 tariffs on Chinese goods and to add or increase tariffs on the following products.

– Battery parts (non-lithium-ion batteries) – from 7.5 percent to 25 percent in 202

– Electric vehicles – from 25 percent to 100 percent in 2024

– Lithium-ion electrical vehicle batteries – from 7.5 percent to 25 percent in 2024

– Lithium-ion non-electrical vehicle batteries – from 7.5 percent to 25 percent in 2026

– Medical gloves – from 7.5 percent to 25 percent in 2026

– Natural graphite – from 0 to 25 percent in 2026

– Other critical minerals – from 0 to 25 percent in 2024

– Permanent magnets – from 0 to 25 percent in 2026

– Personal protective equipment – from 0-7.5 percent to 25 percent in 2024

– Semiconductors – from 25 percent to 50 percent by 2025

– Ship-to-shore cranes – from 0 to 25 percent in 2024

– Solar cells (whether or not assembled into modules) – from 25 percent to 50 percent in 2024

– Steel and aluminum products – from 0-7.5 percent to 25 percent in 2024

– Syringes and needles – from 0 to 50 percent in 2024

USTR is also recommending (1) an exclusion process limited to machinery used in domestic manufacturing provided for under specified eight-digit HTSUS numbers (see appendix K in the USTR report), (2) temporary exclusions for certain solar manufacturing equipment (see appendix L), (3) allocating additional funds to U.S. Customs and Border Protection for greater enforcement of Section 301 tariffs, (4) greater collaboration and cooperation between private companies and government authorities to combat state-sponsored technology theft, and (5) continuing to assess approaches to support diversification of supply chains to enhance supply chain resilience.

USTR’s announcement did not include any information on the May 31 expiration of hundreds of tariff exclusions.

Importers of goods subject to the proposed tariff increases should contact ST&R to discuss options for avoiding or ameliorating those higher costs. ST&R can also help importers of machinery that may be eligible for new tariff exclusions to navigate that process. For more information on these or other topics related to the Section 301 tariffs, please contact your ST&R professional or via this email.

Tremendous Demand USWC / Proposed May 15 GRI

There is tremendous demand for the following reasons:

1. Carriers and importers are stopping to ship to North America via Canada due to the pending Canadian Rail and Port strikes. Most of the cargo that previously moved over Canadian Ports has been diverted to move over the US West Coast Ports. Now there is more than a 2 week back up for fresh bookings to USWC,

Below is a quick synopsis.

A) Rail Strike. The Teamsters of the Canadian Rail voted yes to go on strike. The cooling off period ends May 21st so they are expected to not report to work on May 22nd at both the CN and CP so Canadian rail service is expected to stop.

B) Canadian East Coast Port Strike. The longshore workers of Montreal have been working without a contract since January 1st and have been threatening to strike. It is anticipated that they will support the Teamsters of the Canadian rail and go on strike with them.

C) Canadian West Coast Port Strike. The ILWU longshore workers of the Canadian West Coast have been negotiating a contract for an extended period of time. The last three days they have had mediation managed by the Canadian Government. If an agreement is not reached today, management can lock them out and the longshore workers can go on strike. We are awaiting the outcome of today’s final day of meetings.

2. Replenishment of depleted inventories is happening. Many companies ran down their stock of goods and are feverishly trying to bring in more goods. Q1 2024 Transpac container shipments are up 33% over Q1 2023. Q2 2024 vs Q2 2023 is trending the same way.

3. Ocean carriers canceled 20% of all sailing for the first two weeks of May to drive up demand and selling costs.

With this tremendous demand we have seen climbing high spot rates including a likely upcoming $1,000 GRI on May 15th. The carriers are doing everything possible to make more profit including delaying implementation of fixed rates and starting to apply early peak season surcharges on fixed rates.

If you have any questions about this information, please contact your local BOC representative.

The BOC Blast 488 05-03-2024 Canadian National & Canadian Pacific Kansas City Workers Vote to Strike

Canadian National & Canadian Pacific Kansas City Workers Vote to Strike

The largest railways in Canada have seen a vote by their employees to go on strike, which may cause a devastating labor disruption and halt the movement of freight shipments nationwide.

While both parties in the labor negotiations remain far apart, the Teamsters Canada Rail Conference (TCRC) union reports that its members who work at Canadian National (CN) and Canadian Pacific Kansas City (CPKC) voted decisively in favor of a strike mandate.

As early as May 22nd, the Teamsters could now demand a nationwide rail strike. If a strike mandate is enacted, approximately 9,900 train conductors, locomotive engineers, and other employees would be impacted.

According to the union, of the 92% of voters that turned up to cast ballots, 98% of said voters supported a strike mandate. All four negotiating groups returned different percentages; however, none was less than 95% in favor of a strike.

The 60-day conciliation period between the railroads and the unions ends with the strike mandate vote. There is now a 21-day cooling-off period for both parties. Until the cooling-off period is over, no lockout or strike is permitted.

Customers of CN were notified yesterday (May 1st) that CN had met on April 29th and 30th to negotiate a contract with TCRC union representatives, with assistance from government conciliators.

According to CN, the union will be unable to get together again until May 13th.

With May 22nd as the possible date that a labor disruption could be initiated, CN’s perspective remains cautious that a deal can be finalized by this date.

If you have any questions please feel free to contact your local BOC representative.

Port of Baltimore – Ocean Carrier Notices

Please find below carrier notices regarding the ongoing situation in Baltimore. If you have any questions, please feel free to reach out to your local BOC Representative.

COSCO:

Notice of Force Majeure Baltimore Shipments Contingency Plan

2024-03-27

Dear Valued Customer,

We hereby notify you that, based on the information currently accessible to us, the Port of Baltimore will be indefinitely closed following the collision of the 948-foot container vessel ‘DALI’ with the Francis Scott Key Bridge on March 26th.

Based on the circumstances mentioned above, we will declare force majeure in accordance with Clause 20 of our Bill of Lading Terms and Conditions, and we wish to communicate our contingency plan regarding shipments to/from Baltimore as outlined below, until further notice:

1. For Shipments from Baltimore:

Shipments currently at the terminal will remain there till the port reopens, unless otherwise directed by the shipper.

For shipments in transit: Given the temporary suspension of export operations at the terminal, please liaise with COSCO SHIPPING North America customer service for alternative port of loading options.

We regret to inform you that no new export bookings will be accepted from Baltimore until further notice.

2. For Shipments to Baltimore:

Shipments currently in transit will be redirected to an alternate port, where they will be made available for pick-up, and COSCO SHIPPING’s bill of lading will be concluded.

For booked cargoes not yet loaded at the origin, please coordinate with the origin booking party.

We extend our sincere appreciation for your ongoing trust and support during this challenging time. Should you have any questions or require additional assistance, please do not hesitate to reach out to your local sales representatives.

Warm regards,

COSCO SHIPPING Lines

Maersk:

Cargo to and from Port of Baltimore: TA2, TA5, TP12, Amex, AGAS

26 March 2024

In the early hours of 26 March 2024, a vessel collided with the Francis Scott Key bridge, resulting in damage to the structure. Information on the situation remains pending and we remain in close contact with officials in the area.

We can confirm that the container vessel “DALI”, is owned by Grace Ocean, and operated by Synergy Group. It is time chartered by Maersk and is carrying Maersk customers’ cargo. No Maersk crew and personnel were onboard the vessel.

Due to the damage to the bridge and resulting debris, it will not be possible to reach the Helen Delich Bentley port of Baltimore for the time being. In line with this, we are omitting Baltimore on all our services for the foreseeable future, until it is deemed safe for passage through this area.

For cargo already on water, we will omit the port, and will discharge cargo set for Baltimore, in nearby ports. From these ports, it will be possible to utilise landside transportation to reach final destination instead. Your local Maersk representative can assist in booking this.

Please note that for cargo set to discharge in Baltimore, delays may occur, as they will need to discharge in other ports. We are keeping a close eye on the safety situation in the area and continuing to assess the viability of transportation through the area. We will inform you of any changes that may impact your cargo.

We are deeply concerned by this incident and are closely monitoring the situation. We understand the potential impact this may have on your logistics operation, and will communicate to our customers once we have more details from authorities. Our teams are on hand to support with your planning, should you need any assistance.

For more information on your cargo, please reach out to your local Maersk representative.

Our teams are on hand to support with your planning, should you need any assistance.

Disaster in Baltimore: Containership Dali collides with Francis Scott Key Bridge

At approximately 1:37 AM today March 26th, 2024 the containership Dali collided with the Francis Scott Key Bridge in Baltimore. The collision caused the bridge to collapse leaving several people missing. Search and rescue operations resumed this morning. The collapse has shut down all operations in and out of the Port of Baltimore.

The containership Dali was departing the Port of Baltimore when the collision occurred. The vessel was part of Maersk’s TP12 service and was departing Baltimore and was sailing for Colombo Sri Lanka. Additional information regarding the collision can be found on the “What is Going on With Shipping” YouTube channel. Follow the link below for the latest information.

BOC will continue to monitor the situation and will provide additional details once they become available. If you have any questions, please reach out to your local BOC representative.

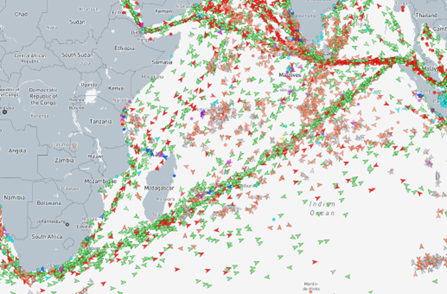

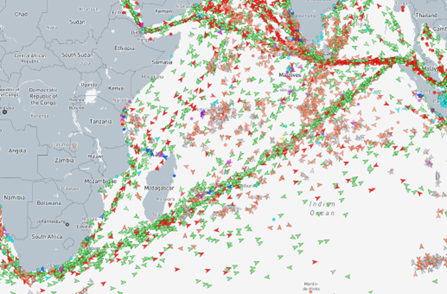

Ocean Carrier Diversions: Suez & Panama

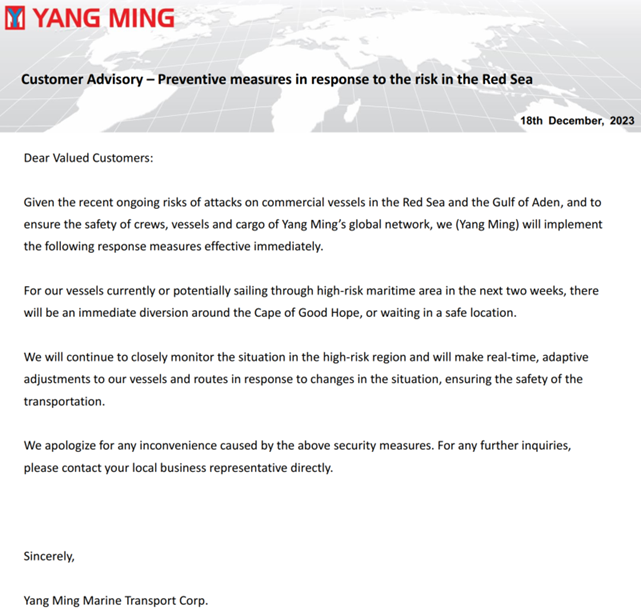

YML/CMA/Hapag/HMM/Maersk/MSC/ONE/Evergreen: Vessels currently or potentially sailing through high-risk maritime area, will initiate an immediate diversion around the Cape of Good Hope, or vessels will hold and wait in a safe location.

Not only are eastbound vessels to the United States impacted, but westbound vessels back to Asia have been temporary re-routed. These changes in routing will cause schedules to extend out 4-6 weeks. Space throughout the end of this year and into January will remain tight. BOC suggests that our clients place bookings as far in advance as possible or provide a forecast as far out as possible. Compounding this space crunch is the coming Chinese New Year (February 10th, 2024) shipping surge as most factories will shut down by February 5th.

www.MarineTraffic.com (12/19/23)

Below are the latest carrier announcements regarding their plans to handle the ongoing shipping crisis. If you have any questions please feel free to contact your local BOC representative.

Yang Ming

CMA-CGM

HAPAG-LLOYD

Hyundai Merchant Marine

MAERSK

MSC

ONE

EVERGREEN

Importers Could Face Higher Tariffs Jan. 1

December 11, 2023 // Advisories

Importers of numerous goods from China could face higher tariffs starting Jan. 1, 2024, if hundreds of Section 301 tariff exclusions expire as scheduled Dec. 31. These include more than 300 exclusions of various products (click here for full list) as well as exclusions for 77 medical care products needed to address the COVID-pandemic. These exclusions are currently available for any product that meets the specified HTSUS numbers and product descriptions, regardless of whether the importer filed an exclusion request.

Any reimposed tariffs would join those that remain in effect on hundreds of billions of dollars’ worth of imports from China, which are expected to remain in effect regardless of the results of a review of those tariffs the Biden administration expects to conclude by the end of this year. However, U.S. Trade Representative Katherine Tai has said some changes are possible, including removals and/or additions, as well as a new exclusion process.

In the meantime, efforts to ameliorate the impact of the China Section 301 tariffs are continuing.

– ST&R is advocating for the renewal of all previously approved exclusions and the creation of a process allowing for new exclusion requests (for more information, please contact strdc@strtrade.com).

– There are a number of proven and legitimate ways to effectively avoid the tariffs or limit their impact (click here for more information).