The BOC Blast 485 12-19-2023 Ocean Carrier Diversions: Suez & Panama

Ocean Carrier Diversions: Suez & Panama

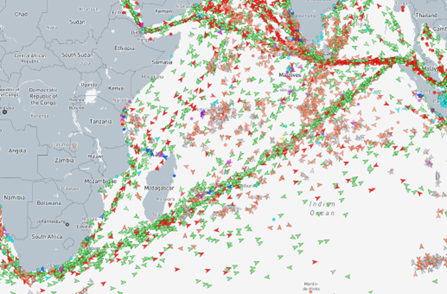

YML/CMA/Hapag/HMM/Maersk/MSC/ONE/Evergreen: Vessels currently or potentially sailing through high-risk maritime area, will initiate an immediate diversion around the Cape of Good Hope, or vessels will hold and wait in a safe location.

Not only are eastbound vessels to the United States impacted, but westbound vessels back to Asia have been temporary re-routed. These changes in routing will cause schedules to extend out 4-6 weeks. Space throughout the end of this year and into January will remain tight. BOC suggests that our clients place bookings as far in advance as possible or provide a forecast as far out as possible. Compounding this space crunch is the coming Chinese New Year (February 10th, 2024) shipping surge as most factories will shut down by February 5th.

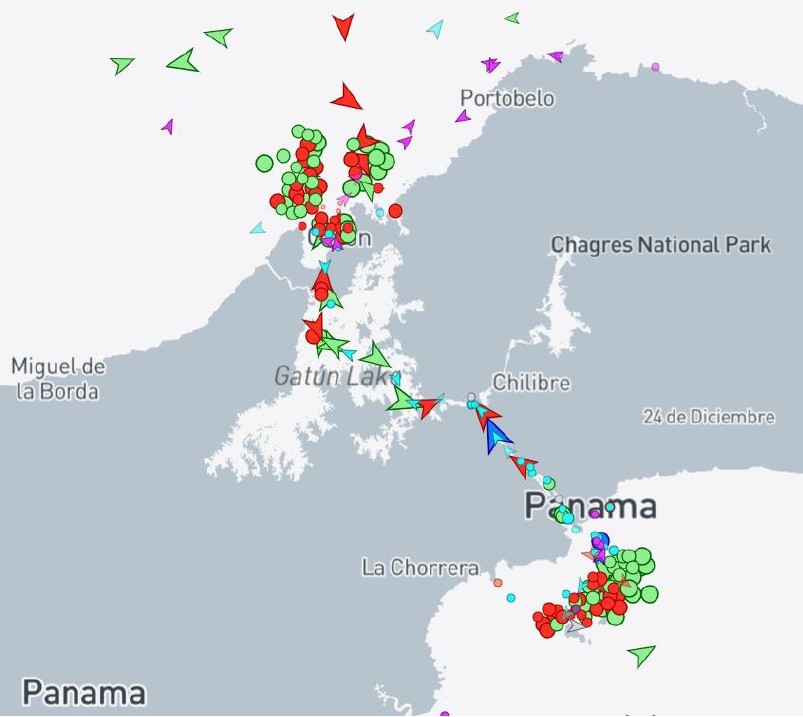

www.MarineTraffic.com (12/19/23)

Below are the latest carrier announcements regarding their plans to handle the ongoing shipping crisis. If you have any questions please feel free to contact your local BOC representative.

Yang Ming

CMA-CGM

HAPAG-LLOYD

Hyundai Merchant Marine

MAERSK

MSC

ONE

EVERGREEN

- Published in The BOC Blast

The BOC Blast 484 12-11-2023 Importers Could Face Higher Tariffs Jan. 1

Importers Could Face Higher Tariffs Jan. 1

December 11, 2023 // Advisories

Importers of numerous goods from China could face higher tariffs starting Jan. 1, 2024, if hundreds of Section 301 tariff exclusions expire as scheduled Dec. 31. These include more than 300 exclusions of various products (click here for full list) as well as exclusions for 77 medical care products needed to address the COVID-pandemic. These exclusions are currently available for any product that meets the specified HTSUS numbers and product descriptions, regardless of whether the importer filed an exclusion request.

Any reimposed tariffs would join those that remain in effect on hundreds of billions of dollars’ worth of imports from China, which are expected to remain in effect regardless of the results of a review of those tariffs the Biden administration expects to conclude by the end of this year. However, U.S. Trade Representative Katherine Tai has said some changes are possible, including removals and/or additions, as well as a new exclusion process.

In the meantime, efforts to ameliorate the impact of the China Section 301 tariffs are continuing.

– ST&R is advocating for the renewal of all previously approved exclusions and the creation of a process allowing for new exclusion requests (for more information, please contact strdc@strtrade.com).

– There are a number of proven and legitimate ways to effectively avoid the tariffs or limit their impact (click here for more information).

- Published in The BOC Blast

The BOC Blast 483 12-06-2023 Suez Canal Attacks & Updated Trans Pacific Schedules

Suez Canal Attacks & Updated Trans Pacific Sailing Schedules

Viewpoint: What Red Sea attacks mean for shipping

Weekend assault on commercial vessels could have impact on global trade.

Lori Ann LaRocco. Monday, December 04, 2023 – FreightWaves.com

The guided missile destroyers USS Carney, left, and USS Ramage sail together in the eastern Mediterranean Sea on Oct. 16. (Photo: Navy Petty Officer 2nd Class Aaron Lau/U.S. Navy)

Geopolitical tensions and attacks in the Red Sea have increased since the commencement of the Israel-Hamas conflict. Iran-backed Houthi rebels have focused their attacks in the Red Sea and Gulf of Aden on any merchant shipping that they believe is affiliated with Israel. Following this weekend’s four attacks on three civilian ships near Yemen, the U.S. Navy destroyer USS Carney responded, thrusting the security of trade into the spotlight.

The Red Sea is the superhighway to the Suez Canal. Judah Levine, Freightos’ head of research, said the Suez Canal sees 50-60 vessels transiting each day for about 19,000 each year, including about 30% of global container traffic.

The Suez has seen an increase in U.S. energy and grain exports as well as U.S. eastbound container imports as the Panama Canal drought restrictions are constricting the flow of trade.

The biggest source of worry is the timeliness of the Houthis vessel data. A Houthi military spokesperson confirmed it targeted a container ship with a drone and another bulk grain vessel because it claimed both vessels were linked to Israel. One, however, was not. Houthis reportedly had outdated information, according to maritime security firm Ambrey.

According to the U.S. Central Command (Centcom), the bulk vessel — Number 9 — that was attacked Sunday is owned by U.K.-based Castle Harbour and operated by U.K.-based Bernhard Schulte Shipmanagement (BSM) and not connected to Israel. The operator appeared to change from Zim in November 2021, according to Ambrey. MarineTraffic shows the vessel left Singapore on Nov. 22 and was slated to go through the Suez Canal this Wednesday.

Ambrey has advised company security officers to assess whether their vessels were owned or managed by an Israel-affiliated company within the last year. But the Israel connection seems to go to the individual level.

Centcom reported that another one of the four vessels attacked was the Bahamas-flagged Unity Explorer. While owned and operated in the U.K., the Israel connection is among its management. Unity Maritime is controlled by Danny Ungar, the son of Israeli shipping businessman Abraham “Rami” Ungar. In November, Ungar’s shipping company, Ray Car Carriers, had its 5,100-unit car carrier Galaxy Leader hijacked by the Houthis.

Unity Explorer is a dry bulk ship that was loaded with grain from the U.S. Cargill grain elevator and transported from the Gulf of Mexico. The vessel left Nov. 2 bound for Singapore and traveled through the Suez Canal approximately six days ago, according to MarineTraffic.

In a statement following the attacks, Centcom said, “These attacks represent a direct threat to international commerce and maritime security. They have jeopardized the lives of international crews representing multiple countries around the world. We also have every reason to believe that these attacks, while launched by the Houthis in Yemen, are fully enabled by Iran. The United States will consider all appropriate responses in full coordination with its international allies and partners.”

But given the misidentification by Houthis of the Number 9, should any ocean carrier that was once linked to Israel consider itself a target because the militants may be working with old information? Does this also mean we could be looking at a war risk premium for vessels traversing the Red Sea and Gulf of Aden if we see more of these attacks?

What this means for trade

War stokes inflation and these attacks can only add to the threat of more war risk premiums. There is currently a war risk premium for vessels going to Israel. In light of the latest attacks and the misidentification of a vessel by Houthis, we may see the war risk premium expanded throughout the Red Sea and Gulf of Aden. This will only add to the inflationary pressures of using this trade route.

The Suez Canal Authority recently announced an increase of 5%-15% in transit fees, taking advantage of the increase in vessel traffic as more ocean carriers avoid the Panama Canal.

“As we saw in the Black Sea, continued attacks on maritime vessels may lead insurance companies to initiate a ‘war risk’ premium for vessels transiting the Red Sea and the shipping lanes south of Yemen,” said Alan Baer, CEO of OL USA. “If initiated, carriers may have no choice but to pass this additional cost onto exporters and importers the world over.”

When it comes to trade, it has to flow regardless of the situation. Operators will have vessels change course for safety.

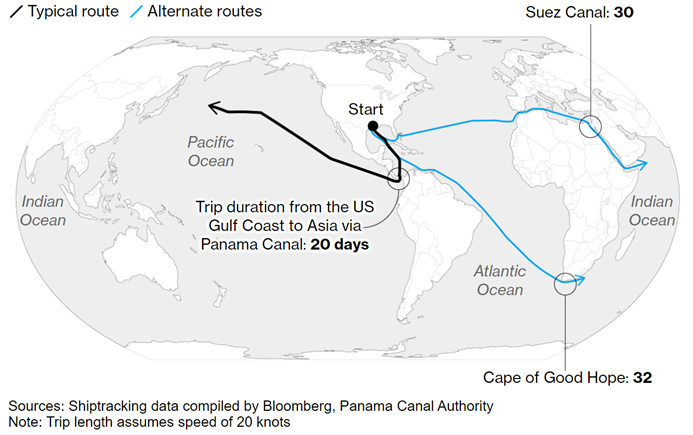

Levine said there have been a handful of examples of Israeli-owned vessels diverting from passage through the Suez Canal and instead sailing around Africa’s west coast and Cape of Good Hope.

“This includes two car carriers, two container vessels operated by Danish carrier Maersk and at least one container vessel by Israel’s Zim Lines,” he explained. “For ships heading to Israel from Asia, the route around Africa is significantly longer — about 7,000 nautical miles and 10-14 days — than via the Suez Canal. This route also incurs higher fuel costs but avoids Suez Canal fees, which are between $400,000-$700,000 per transit and are set to increase by 15% in January 2024.”

Freightos data shows rates from some Chinese origins to Israel have climbed between 16% and 36%.

“This is suggesting that the war is leading to higher costs for carriers and higher prices for their customers,” Levine said.

To mitigate risks, some Israeli ports are closed because of missiles being launched in the area. For those carriers that cannot find war risk insurance, the Israeli government is offering supplemental insurance. This is nothing new, Israel has offered it for years. The Ukrainian government has also offered war risk insurance for vessels that may not be able to secure the extra coverage.

Levine said Zim is alone among the carriers in introducing a war risk insurance premium of between $20 and $100 per container since the start of the war.

ZIM ZXB: add 2 sailing changes rotation from Panama to Cape of Good Hope (or Suez)

| SVC | Vessel Name / Voyage | ETA | Port | Status | |

| ZXB | ZIM Savannah 20E | 1-Jan-24 | Baltimore | via the Cape of Good Hope | PKL-HCM-HPH-YAM-KAO-SHA-BAL-NFK-NYC-BOS |

| ZXB | ZIM AMERICA 18E | 7-Jan-24 | Baltimore | via the Cape of Good Hope | PKL-HCM-HPH-YAM-KAO-SHA-BAL-NFK-NYC-BOS |

| ZXB | ZIM Coral 1E | 14-Jan-24 | Baltimore | via Suez or Cape of Good Hope | KAO-YAN-HPH-HCM-BAL-NFK-NYC-BOS |

| ZXB | ZIM Emerald 1E | 27-Jan-24 | Baltimore | via the Cape of Good Hope | HPH-KAO-YAN-HCM-BAL-NFK-NYC-BOS |

Ocean Alliance: add 2 sailing via Suez, ETA is 3-5 days later, not too bad

| SVC | Vessel Name / Voyage | ETD | Port | Status | |

| AWE4 | COSCO SHIPPING AZALEA 024E | 2-Dec-23 | Shanghai | switch via Suez Canal | YAN-HKG-XMN-SHA-NYC-SAV-CHS |

| GME | OOCL UTAH 067E | 2-Dec-23 | Hong Kong | switch via Suez Canal | SHA-NBO-XMN-YAN-HKG-HOU-MOB-TPA |

| AWE4 | COSCO HARMONY 075E | 14-Dec-23 | Shanghai | switch via Suez Canal | YAN-HKG-XMN-SHA-NYC-SAV-CHS |

| GME | COSCO MALAYSIA 097E | 10-Dec-23 | Yantian | switch via Suez Canal | SHA-NBO-XMN-YAN-HOU-MOB-TPA |

The Alliance: all Dec vessel changes to Suez routing

| SVC | Vessel Name / Voyage | ETD | Port | Status | |

| EC1 | MADRID EXPRESS V.016E | 27-nov-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | BASLE EXPRESS V.048E | 3-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | DORTMUND EXPRESS V.051E | 8-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | ULSAN EXPRESS V.045E | 14-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC2 | AL QIBLA EXPRESS V.030E | 27-nov-23 | Pusan, KR | switch via Suez Canal | TAO-YAN-NBO-SHA-BUS-SAV-CHS-WIL-NFK |

| EC2 | NEW YORK EXPRESS V.030E | 2-Dec-23 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC2 | AL RIFFA V.025E | 8-Dec-23 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC6 | EVER SMILE V.114E | 28-nov-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC6 | MOL CELEBRATION V.094E | 29-nov-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC6 | MOL COURAGE V.056E | 5-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC1 | AIN SNAN EXPRESS 031E | 20-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | JEBEL ALI 027E | 30-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | HYUNDAI HOPE 0053E | 14-Jan-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC1 | HYUNDAI VICTORY 0051E | 22-Jan-23 | Pusan, KR | switch via Suez Canal | KAO-YAN-XMN-SHA-NBO-BUS-NYC-NFK-CHS-SAV |

| EC2 | ESSEN EXPRESS 0046E | 14-Dec-23 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC2 | TAYMA EXPRESS 0029E | 23-Dec-23 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC2 | ALULA EXPRESS 0031E | 30-Dec-23 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC2 | SOUTHAMPTON EXPRESS 0038E | 10-Jan-24 | Pusan, KR | switch via Suez Canal | TAO-NBO-SHA-BUS-YAN-SAV-CHS-WIL-NFK |

| EC6 | ONE MISSION 0071E | 13-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC6 | ONE CONTINUITY 0066E | 19-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC6 | ONE COSMOS 0095E | 25-Dec-23 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

| EC6 | EVER SAFETY 0111E | 2-Jan-24 | Pusan, KR | switch via Suez Canal | KAO-HKG-YAN-NBO-SHA-HOU-MOB |

- Published in The BOC Blast

The BOC Blast 482 12-05-2023 Panama Canal Turns From Trade Catalyst to Chokepoint

Panama Canal Turns From Trade Catalyst to Chokepoint

By Ruth Liao. December 5, 2023 at 7:00 AM EST

For more than a century, the Panama Canal has been a catalyst for consumer goods and raw materials flowing between the Americas, Asia and beyond. Thanks to climate change, it’s now a chokepoint.

A drought is reducing water levels in a nearby lake used to manage the depths for cargo ships passing through its locks. That’s led to tonnage restrictions and fewer vessels transiting the shortcut each day, causing delays. Those unwilling to wait have two options: pay hefty fees to jump the queue, or sail a much greater distance around South America, Africa or through the Suez Canal.

Panama Canal Jam Spurs Alternate Ship Routes

Shippers face higher costs with either increased voyages or surging canal fees.

Hapag-Lloyd, the world’s No. 5 container carrier, recently started a “live ticker” showing the rerouting of its ships.

Such choices add costs, creating headwinds for central bankers around the world who are struggling to tame inflation.

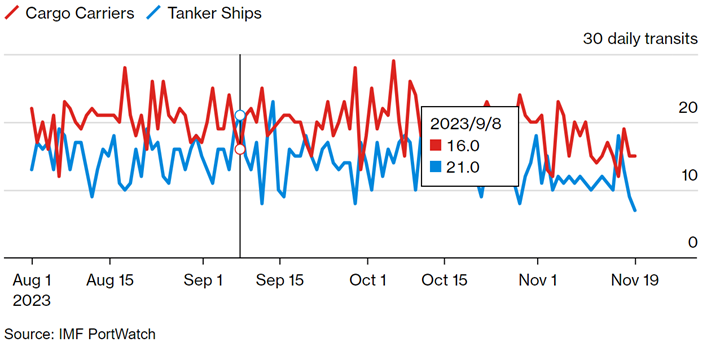

According to the IMF’s PortWatch congestion monitor, the number of daily transits through the canal has declined by about one-third since Aug. 1 to 22 vessels. That’s expected to go down even more in coming months, reaching 18 daily crossings by Feb. 1, according to Clarksons Research.

Falling Water Means Fewer Panama Canal Transits

Daily ship crossings have declined by about one-third since Oct. 1

The snarl will only worsen in the coming months as Panama enters its annual dry season, which typically begins in December and lasts until April or May.

“Transit restrictions appear likely to remain in place for some time to come, with the rainy season in Panama falling from May to December, and the months with the greatest average rainfall being October and November,” according to a Dec. 1 research note from Clarksons. “Restrictions may not be significantly eased until the second half of 2024 or later.”

- Published in The BOC Blast

The BOC Blast 481 11-29-2023 Further Restrictions in Panama Canal Announced

Further Restrictions in Panama Canal Announced

During Q2 2023, the Panama Canal Authority announced it would reduce draft from 14.94 meters to 13.41 meters. Despite several measures to conserve water taken over the previous months, lack of precipitation in the area is affecting the water level of the Panama Canal. Consequently, the Panama Canal Authority has recently confirmed further restrictions regarding the number of vessels crossing the canal. Many steamship lines have also announced delays, restrictions and surcharges.

MarineTraffic.com 11/29/23

Tuesday, November 21, 2023

CMA CGM informs its customers that the Panama Canal continues to suffer from severe drought, consequently, the Panama Canal Authority has recently announced further restrictions.

During Q2 2023, and despite several water conservation measures, the canal draft was reduced from 14.94 to 13.41m.

The lack of precipitation over the summer months has forced the Panama Canal Authorities to reduce the number of vessels transiting per day. As a consequence, by January 1st 2024, the booking windows for transiting the Neopanamax locks will be reduced by -30%.

These restrictions combined with an increase in the Canal Tariff implemented earlier in the year, are taking a severe toll on CMA CGM’s operations.

PANAMA CANAL SURCHARGE

MSC CUSTOMER ADVISORY

Geneva, Switzerland, 23 November 2023

Dear Customers,

During Q2 2023, the Panama Canal Authority decided to reduce draft from 14.94 to 13.41. Despite several measures to conserve water taken over the last months, lack of precipitation in the area is affecting the water level of the Panama Canal. Consequently, the Panama Canal Authority has recently confirmed further restrictions regarding the number of vessels crossing the canal.

These restrictions, combined with the increase of the Canal Tariff implemented earlier this year, are having a direct impact on overall MSC operations costs.

Transpacific Eastbound: Panama Canal Adjustment Factor

23rd November 2023

Dear ZIM Customer,

The Panama Canal Authority has recently announced further restrictions on vessels crossing the canal, following the historically low water level in Panama.

The number of vessels passage the Neopanamax locks will be further reduced, combined with an increase of the Canal Tariff implemented earlier this year, increased our operation cost substantially. To recover the extra expenses on Asia to US East coast and US Gulf services crossing the Panama Canal, Zim will implement a new Panama Canal Adjustment Factor (PCA), starting December 15, 2023.

Here’s an update on the Panama Canal situation

In the face of the most severe drought the Panama Canal has experienced in half a century, we are working towards adjusting our operational outlook to support your cargo planning. The drought has had a serious impact on container ships by posing draft limits whereby space and weight allocations are challenged. In addition, the daily vessel transit has been capped to a specific number of vessels per day, presenting additional challenges to transit the Panama Canal on time.

Despite our preparations, the canal’s restrictions present uncertainties, and therefore, we are constantly evaluating the operational situation, including regular discussions with the authorities to obtain the latest information. In view of this situation, our teams are engaged in taking all the necessary measures to continue supporting your supply chain requirements.

- Published in The BOC Blast

The BOC Blast 480 11-28-2023 ZIM Re-Routes Ships to Avoid Yemeni Coast

ZIM Re-Routes Ships to Avoid Yemeni Coast

Mike Schuler, gcaptain.com

Israeli shipping line ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) says it will re-route vessels to avoid the Arabian and Red Seas amid threats to Israeli-linked ships in the region by the Yemen-based Houthi militant group.

The announcement comes after at least three ships have been targeted in the past week or so.

The company issued a statement Monday reiterating its continued commitment to serving the East Mediterranean and Israeli ports amid Israel’s war with Hamas.

“Operations to and from these ports will be maintained with the highest regard for safety protocols which are essential to safeguarding the interests of all stakeholders,” the company said.

However, the company said that in light of the threats, it is taking “temporary proactive measures” to ensure the safety of its crews, vessels, and customers’ cargo by re-routing some of its vessels, which will result in longer transit times.

“ZIM is closely monitoring the situation to address potential risks and ensure the ongoing safety and efficiency of its operations,” the statement said.

The announcement comes after a series of attacks on internationally-trading ships linked to Israeli businesses after Houthi’s leader threatened further attacks on Israel and Israeli ships in the Red Sea and Bab al-Mandab.

“Our eyes are open to constantly monitor and search for any Israeli ship in the Red Sea, especially in Bab al-Mandab, and near Yemeni regional waters,” Abdulmalik al-Houthi said in a broadcasted speech on November 14.

On November 19, the Galaxy Leader car carrier was hijacked by the Houthis and taken to Yemen’s Hodeidah port area along with its 25 crew members. The ship is still being held. Over the weekend, the chemical tanker Central Park was boarded by armed assailants in the Gulf of Aden, prompting a response from the U.S. Navy destroyer USS Mason. Five individuals now described as being of Somali nationality were captured in the incident, raising questions about the origin of the assailants. Following the rescue, two ballistic missiles were fired towards the Mason and Central Park, but the missiles landed in the water about 10 miles from the vessels.

In addition, on November 24 the Maltese-flagged M/V CMA CGM SYMI was reportedly attacked by an unmanned aerial vehicle (UAV) in the Indian Ocean, but did not sustain serious damage.

All three ships have links to Israel.

At least one ZIM ship, the MV ZIM Europe has been identified as re-rerouting down the west coast of Africa, presumably around the Cape of Good Hope, during a voyage from the U.S. East Coast to Port Klang, Malaysia.

Since Hamas’ brutal October 7 attack on Israel, U.S. Navy destroyers have shot down missiles and drones launched from Yemen on at least two other occasions.

ZXB – Vessel Diversion – Zim Savanah Voyage 20E – Updated

28th November 2023

Dear ZIM Customer,

Due to the ongoing restrictions in the Panama Canal and subsequent heavy delays, and in light of the threat to the safe transit of global trade in the Arabian and Red Seas, we wish to inform you that we have decided to divert the ZXB ZIM Savannah 20/E Voyage to sail via the Cape of Good Hope.

ZIM is taking temporary measures to ensure the safety of its crews, vessels, and customers’ cargo by rerouting some of its vessels. We make every effort to minimize disruptions and closely monitor the situation to ensure the ongoing safety and efficiency of operations.

Below is her tentative schedule for your reference:

| Port | ETA |

| Cartagena | 26/12/2023 |

| Baltimore | 1/1/2024 |

| Norfolk | 3/1/2024 |

| New York | 5/1/2024 |

| Boston | 7/1/2024 |

- All cargo bound for Mexico will be discharged in Shanghai to connect alternative service.

A separate notification will be sent to cargo owners for further connection details.

We thank you for your understanding on this matter.

Our customer service team and sales representatives are at your disposal for any inquiries.

- Published in The BOC Blast

The BOC Blast 479 9-27-2023 USWC/USEC base port from 9/26 to 10/14

USWC/USEC base port from 9/26 to 10/14

Wk40 (during long holiday) + wk41 (after long holiday), you can say 1st half of Oct, space capacity cut almost 50%

| Shipping Line | Route | Blank Sailings (Week) |

| Ocean Alliance | PSW | AAC4/CEN – wk41 omit, AAC2 – wk40 omit, AAS2 – wk39 & wk41 omit, AAS3 – wk40 & wk42 omit, AAC – wk40 & wk41 omit, SEA2 – wk42 omit |

| PNW | OPNW – wk39 & wk41 no vessel, CPNW – wk40 & 41, no vessel, MPNW – wk40 & 41, no vessel, EPNW – wk40 omit | |

| USEC | AWE1 – wk41 omit, AWE2 – wk39 & 40 omit, AWE3 – wk40 omit, AWE4/AWE7 – wk40 & 41, no vessel, ISE – wk39/41/42 omit | |

| Gulf | GME – wk40 & 41, no vessel, GME2 – wk41 & wk42 no vessel | |

| CMA EXX | wk41 omit | |

| The Alliance | PSW | PS3/PS6/PSX – wk41 omit, PS4 – wk42 omit |

| PNW | PN3 whole svc withdraw from Oct, PN4 – wk40 omit | |

| USEC | EC1 – wk40 & wk42 omit, EC2 – wk41 omit | |

| Gulf | EC6 – wk43, no vessel | |

| MSK/MSC/ZIM | PSW | TP2 – wk41 omit, TPX & TP6 – wk40 omit |

| PNW | TP1 – wk40 omit, ZNP – wk39/41/42 omit | |

| USEC | TP16 – wk41 omit, TP12 – wk40 omit, TP10 – wk41 & wk43 omit | |

| ZIM ZXB | wk39 & wk41 omit | |

| MSC Santana | wk42 & wk43 omit | |

| MSC Sentosa | WK40 & 41 omit | |

| WHL | PSW | AA3 – wk39/40/42 no vessel |

| USEC | AA7 – wk41 omit |

- Published in The BOC Blast

The BOC Blast 476 8-07-2023 Canada West Coast Strike Ends – ILWU Canada Votes To Accept Port Labor Agreement

Canada West Coast Strike Ends

ILWU Canada Votes To Accept Port Labor Agreement

Excerpted from Reuters.com, August 5, 2023, by David Ljunggren

Dock workers in western Canada voted to accept an improved labor contract after a month-long dispute that affected trade and disrupted operations at the country’s busiest ports, their union said on Friday.

The vote was 74.66% in favor of the terms of the settlement, the International Longshore and Warehouse Union (ILWU) said in a statement.

Disagreements in contract negotiations have disrupted billions of dollars in trade, raising concerns about fueling inflation.

The union provisionally agreed to a new contract on Sunday, averting an immediate strike, but the agreement needed to be approved by workers.

The government had directed the Canada Industrial Relations Board to resolve the dispute after workers rejected a previous contract. Ottawa was seeking to keep two of Canada’s three busiest ports – Vancouver and Prince Rupert – open.

Canada’s Minister Of Labour Seamus O’Regan and the British Columbia Maritime Employers Association (BCMEA) confirmed that the ILWU had ratified the deal.

B.C. port dispute ends as workers vote to accept new deal

Excerpted from CBC.ca, June 6

Nearly 75 per cent of union members voted to approve the tentative agreement

Port workers in British Columbia have accepted a new tentative deal with their employers, bringing an end to a tumultuous, weeks-long contract dispute that has paralyzed industries and supply chains across Canada.

Late on Friday, the International Longshore and Warehouse Union Canada (ILWU) says the vast majority of its more-than-7,400 members voted to ratify a deal reached with help from the Canada Industrial Relations Board (CIRB).

The two-day vote closed at 6 p.m. PT on Friday.

“The results of the ratification vote for the tentative agreement show 74.66 per cent in favour of accepting the terms of settlement,” ILWU president Rob Ashton wrote in a letter posted to the union’s Facebook page shortly before 8 p.m. PT on Friday.

Both the ILWU and the employers, represented by the B.C. Maritime Employers Association (BCMEA), have now ratified the deal.

- Published in The BOC Blast