The BOC Blast 376 – USEC Golden Week Blank Sailing Contingency Plans

USEC Golden Week Blank Sailing Contingency Plans

Please be informed that during the upcoming China’s National Golden Week period in October 2020, CMA CGM will make the following service adjustments.

Cargo for the impacted services will be rolled to the next week’s sailing or shifted to the alternative services listed.

Below please find the CMA CGM Blank Sailing Program:

Contingency plans:

PEX 3 – Cargo originally booked on 0PG7XE1MA will be delayed to 0PG7ZE1MA

VESPUCCI – EVER LEADING (OVC7FE1MA) – ETD Qingdao 06-OCT

1. All Boston cargo will load on next Vespucci voyage – EVER LIBERAL (0VC5PE1MA) – ETD Qingdao 13-OCT: ETA delay 7 days

2. Qingdao / Ningbo / Pusan and Pusan transshipment cargo to Charleston to be routed via Hong Kong & will load on the South Atlantic Express – OOCL BRUSSELS (0UP7PE1MA) – ETD Hong Kong 01-OCT: ETA delay 2 days

3. Shanghai cargo to Savannah / Charleston / New York will load on the South Atlantic Express – OOCL BRUSSELS (0UP7PE1MA) – ETD Shanghai 06-OCT

• ETA New York: advance 10 days

• ETA Savannah: delay 2 days

• ETA Charleston: delay 2 days

4. Qingdao / Ningbo / Pusan and Pusan transshipment cargo to Savannah / New York will switch to the Manhattan Bridge Service – COSCO FORTUNE (0MB71E1MA) – ETD Qingdao 04-OCT

• ETA New York: advance 7 days

• ETA Savannah: delay 7 day

- Published in The BOC Blast

The BOC Blast 375 – Golden Week Blank Sailings

Blanking Announcement for Chinese National Holiday On Transpacific Services

Due to expected slow volume pick-up in connection with the upcoming Chinese National Holiday (Golden Week), Maersk endeavours to balance our network to match reduced demand in October. Below you will find a summary of void sailings on Transpacific services. We aim to minimize the impact to our customers by securing reliable alternative routings.

Please feel free to reach out to your local Maersk Customer Service representatives or check https://www.maersk.com/local-information and https://www.maersk.com/schedules/ for more details.

Far East Asia to North America

North America to Far East Asia

Eagle Express 1 Void Sailing

Please be informed of the following void sailing that will be implemented on our Asia-North America service in September due to scheduled vessel dry dock.

To minimize impact to our customers, alternative sailings are available for your cargo originally intended on the advised void sailing.

Contingency plan for EX1 – PRESIDENT WILSON

• Cargo from Shanghai / Yangtze area / Indonesia to load on vessel voyage CMA CGM ROSSINI (0TXSUE1MA) ETA Shanghai 23-SEP-2020

• Cargo from Qingdao / Lianyungang / Dalian / Xingang / Ningbo / Philippines / Japan / Korea to load on vessel voyage CMA CGM ROSSINI (0TXSUE1MA) ETA Busan 26-SEP-2020

2020 GOLDEN WEEK BLANK SAILINGS – ASIA-NORTH AMERICA NETWORK – UPDATE

The following announcement supersedes our announcement of 8 September 2020 about Asia-North America network blank sailings.

MSC Mediterranean Shipping Company plans to exclude sailings during Golden Week holiday on its Asia-North America Network due to the anticipated slowdown in demand during and after this period.

The change will help us to match capacity with the expected weaker market demand for shipping services. However, you may continue to place bookings as usual as we are arranging alternate routings.

Our blank sailing programme will start as from week 40 as per the below:

ASIA TO U.S. EAST COAST WEEK 40 OMISSION AMBERJACK service Blanking voyage 1E, ETA Tianjin 01.10.2020 To and Via: Kingston, Savannah, Charleston, Jacksonville, Wilmington All shipments from Tianjin, Qingdao, Ningbo, Shanghai, Busan will be served via alternative services.

ASIA TO CANADA AND U.S. WEST COAST WEEK 41 OMISSION MAPLE service Blanking voyage UM41N, ETA Nansha 09.10.2020 To and Via: Prince Rupert, Vancouver All shipments from Nansha, Yantian, Shanghai, Busan, Yokohama will be served via alternative services.

WEEK 43 OMISSION SEQUOIA service Blanking voyage US43N, ETA Yantian 20.10.2020 To and Via: Long Beach All shipments from Yantian, Ningbo will be served via alternative services.

U .S. EAST COAST TO ASIA WEEK 45 OMISSION AMBERJACK service Blanking voyage 10W, ETA Savannah 04.11.2020 To and Via: Busan, Tianjin, Qingdao, Ningbo, Shanghai All shipments from Savannah, Charleston, Jacksonville, Wilmington, Kingston will be served via alternative services.

CANADA AND U.S. WEST COAST TO ASIA WEEK 44 OMISSION MAPLE service Blanking voyage UM44S, ETA Prince Rupert 27.10.2020 To and Via: Nansha, Yantian, Shanghai, Busan, Yokohama All shipments from Prince Rupert, Vancouver will be served via alternative services.

WEEK 46 OMISSION SEQUOIA service Blanking voyage US46S, ETA Yantian 06.11.2020 To and Via: Yantian, Ningbo All shipments from Long Beach will be served via alternative services.

Golden Week Vessel Idling Program Trans-Pacific Service

(San Francisco, CA)…As a result of reduced demand due to Golden Week holiday we will adjust our network to match expected market demands. Below you will find a summary of void sailings:

In light of the above void sailings, the following return voyages will also be voided.

- Published in The BOC Blast

The BOC Blast 374 – Commercial Invoice Requirements

Commercial Invoice Requirements

Requirements of a commercial invoice, bill of sale, receipt that must be provided when filing entry documents for Customs clearance

A commercial invoice should contain enough information for a Customs Officer to determine if the goods being imported are admissible, and if so, the correct classification and valuation of goods. For further guidance, see the Harmonized Tariff Schedule (HTS).

For commercial shipments, the invoice accompanying the importation should include a statement certifying that the goods qualify as originating goods.

There is no specific format for an invoice (see 19 CFR 141.85). However, regulations do provide what information should be included on an invoice.

At a minimum, an invoice should include the following:

- Detailed description of each item, in English (for US entry)

- Quantity of each item, along with weight and measure

- Purchase price of each item, in the currency of the purchase (Ideally, provide the value in origin and destination currency)

- If the items are shipped otherwise than in pursuance of a purchase, then the Value of each item

- Terms of sale

- Country of Origin (where the item was made) of each item

- Where each item was purchased

- Name and address of the business or person selling the merchandise

- Name and address of the business or person buying the merchandise (note if different from the importer)

- The complete name and address of the business or person the goods are being shipped to

The importer will need to present the commercial invoice to Customs when clearing their goods.

For further guidance on US requirements, see 19 CFR 141.86, contents of invoices and general requirements.

NOTE: Every country has their own specific requirements for commercial invoices

21 Drydock Ave Suite 520W Boston, MA 02210 Phone: 617.345.0050 Fax: 617.345.9595

- Published in The BOC Blast

The BOC Blast 372 – Hong Kong Normalization – Transition Period Extended through November 9, 2020. Executive Order 13936

Hong Kong Normalization – Transition Period Extended through November 9, 2020. Executive Order 13936

This notice is to inform the trade that the 45-day transition period for compliance with the President’s Executive Order (EO) on Hong Kong Normalization has been extended for an additional 45 days through November 9, 2020. Additionally, this notice updates the guidance provided in CSMS# 43633412, issued August 11, 2020.

Background

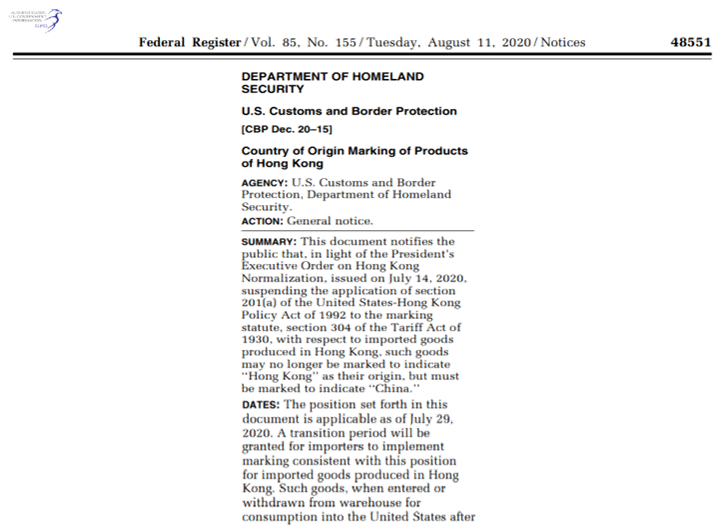

On July 14, 2020, the President issued Executive Order 13936 dealing with Hong Kong Normalization, and suspended, among other things, the application of section 201(a) of the United States-Hong Kong Policy Act of 1992 to certain statutes, including 19 U.S.C. 1304. On August 11, 2020, CBP issued a notice in the Federal Register (85 FR 48551) notifying the public that, unless excepted from marking, goods produced in Hong Kong must be marked to indicate that their origin is “China” for purposes of 19 U.S.C. 1304. The position set forth in the notice became applicable as of July 29, 2020; however, CBP granted a transition period until September 25, 2020 for importers to implement marking consistent with the notice.

Additional 45 days for informed compliance

In an effort to allow importers ample time to comply with EO requirements for goods produced in Hong Kong to be appropriately marked with the origin of “China”, CBP is extending the transition period for an additional 45 days, through November 9, 2020. During this period, CBP personnel from the Ports of Entry and Centers of Excellence and Expertise (Centers) should not take any enforcement actions (i.e., marking notices, marking penalties, etc.) on goods produced in Hong Kong for purposes of 19 U.S.C. 1304. Centers and Ports of Entry should take measures to inform accounts and importers of these new marking rules for Hong Kong set forth in the EO.

This change in marking requirements does not affect country of origin determinations for purposes of assessing ordinary duties under Chapters 1-97 of the HTSUS or temporary or additional duties under Chapter 99 of the HTSUS. Entry summary procedures also have not changed. Given that this new rule only applies to marking requirements under 19 U.S.C. 1304, filers should continue to file their entry summaries and submit payments for applicable duties, taxes and fees in accordance with current regulations and policies.

Should you have any questions regarding this notice, please contact the Trade Agreement Branch at fta@dhs.gov

Related documents:

- GUIDANCE: New Marking Rules for Goods Made in Hong Kong – Executive Order 13936 (CSMS #43633412, August 11, 2020)

- FAQ – Guidance of Marking of Goods of Hong Kong – EO 13936

- Country of Origin Marking of Products of Hong Kong (85 FR 48551, August 11, 2020)

- The President’s Executive Order on Hong Kong Normalization (85 FR 43413, July 14, 2020)

- 1997 FR Hong Kong Customs 97-14662 (62 FR 30927, June 5, 1997)

- Published in The BOC Blast

The BOC Blast 371 – US CBP: Country of Origin Marking of Products, Hong Kong

US CBP: Country of Origin Marking of Products, Hong Kong

Full Federal Register Notice: https://www.govinfo.gov/content/pkg/FR-2020-08-11/pdf/2020-17599.pdf?utm_campaign=subscription+mailing+list&utm_source=federalregister.gov&utm_medium=email

- Published in The BOC Blast

The BOC Blast 370 – 301 Tariffs Update

- Published in The BOC Blast

The BOC Blast 369 – Port of Montreal Strike Potential Monday

- Published in The BOC Blast

The BOC Blast 368 – Information on COBRA User Fee Changes Effective October 1, 2020

CSMS #43511668 – Information on COBRA User Fee Changes Effective October 1, 2020

Pursuant to the General Notice (85 FR 45646) published July 29, 2020, various changes to user fees within the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 will take effect on October 1, 2020. The General Notice may be accessed at the link below:https://www.govinfo.gov/content/pkg/FR-2020-07-29/pdf/2020-16450.pdf

The Merchandise Processing Fee (MPF) ad valorem rate of 0.3464% will NOT change. The MPF minimum and maximum for formal entries (class code 499) will change. The minimum will change from $26.79 to $27.23; and the maximum will change from $519.76 to $528.33.

The fee for informal entry or release (class code 311) will change to $2.18.

The surcharge for manual entry or release will change to $3.27.

The dutiable mail fee (class code 496) will change to $5.99.

Another CSMS will be sent when the changes are in the ACE Certification environment for trade testing.

- Published in The BOC Blast