…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

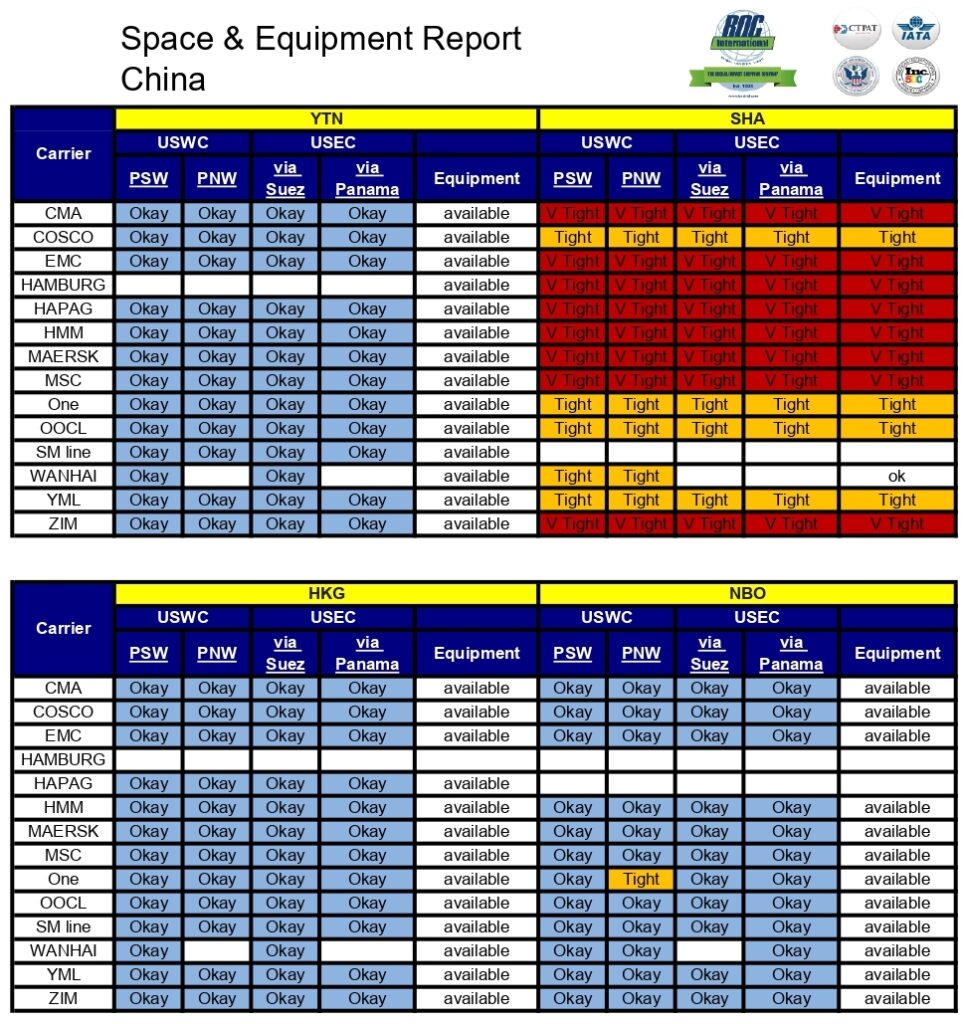

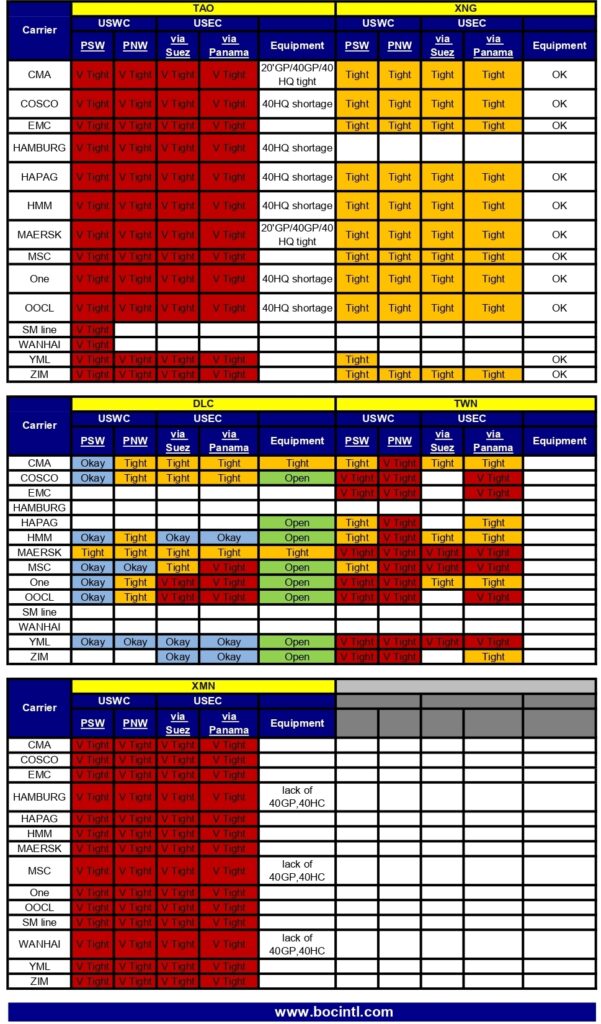

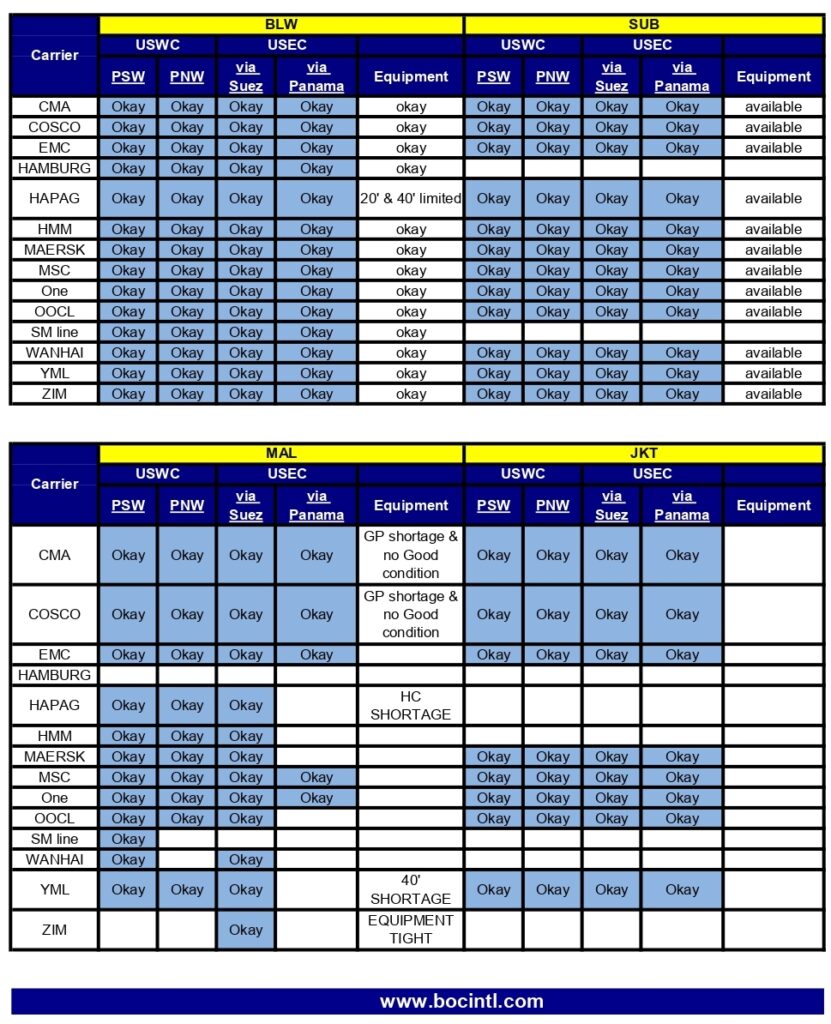

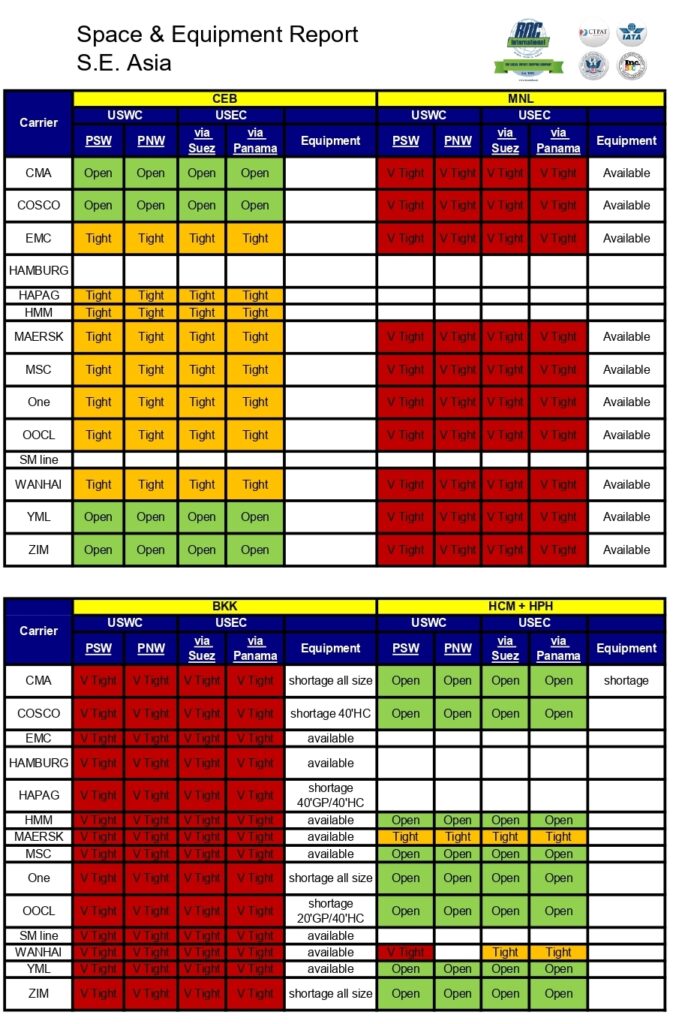

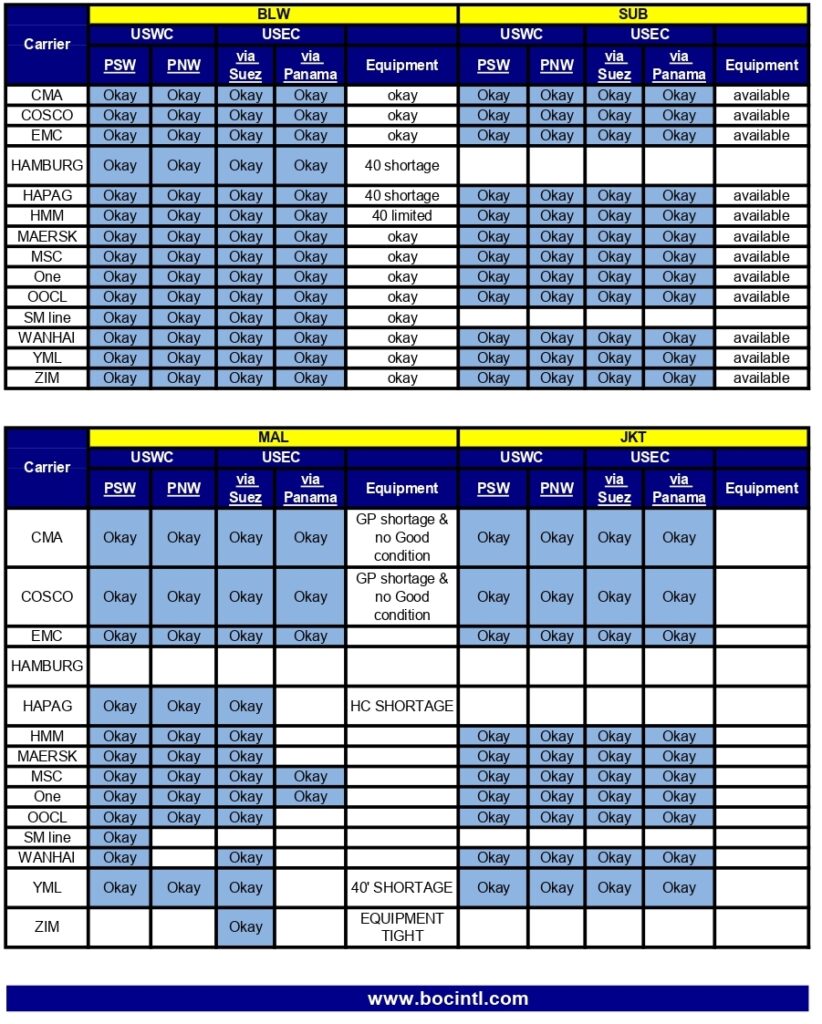

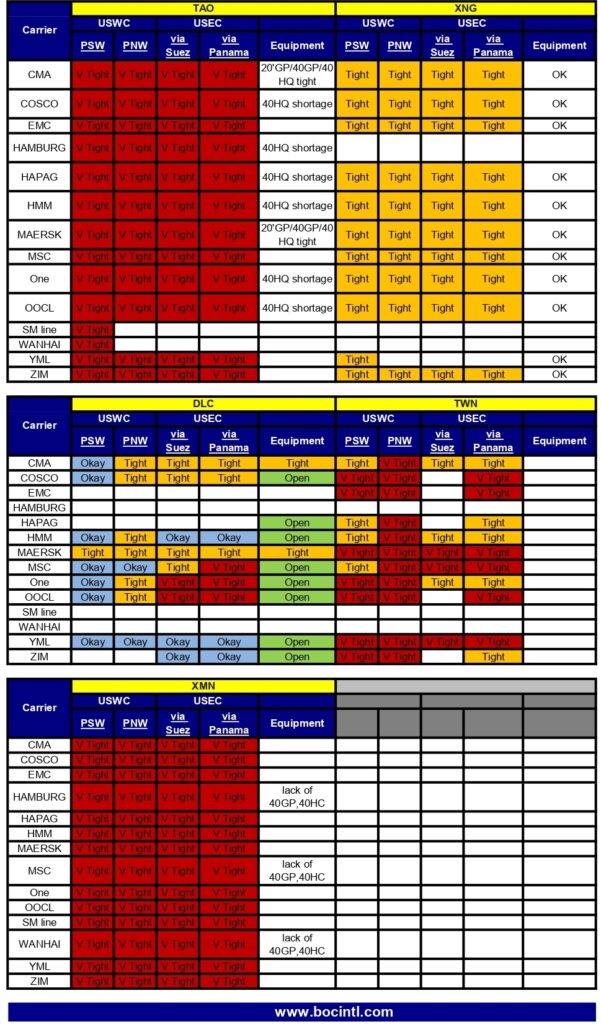

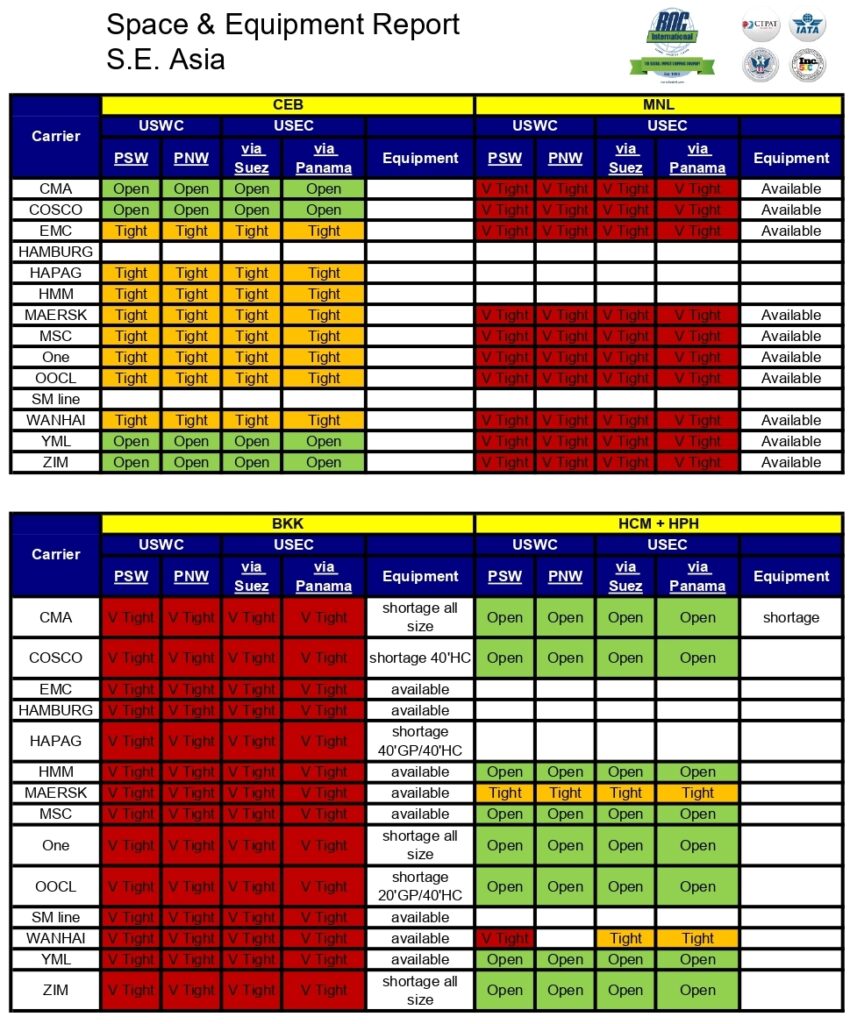

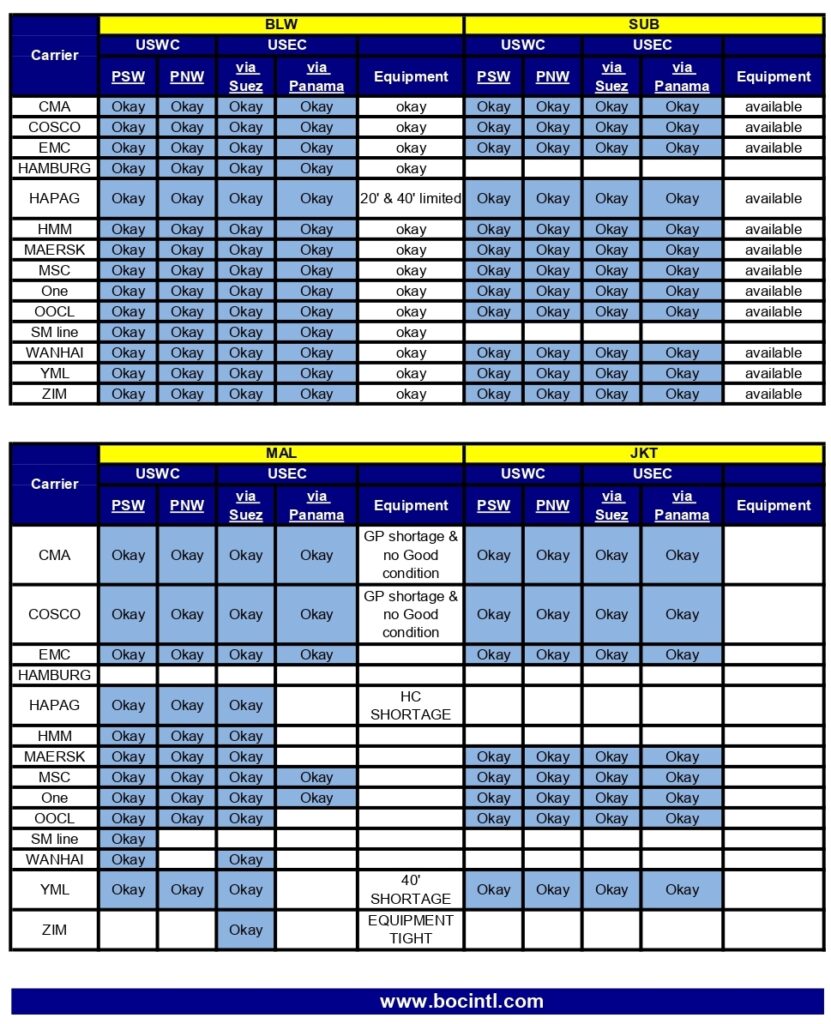

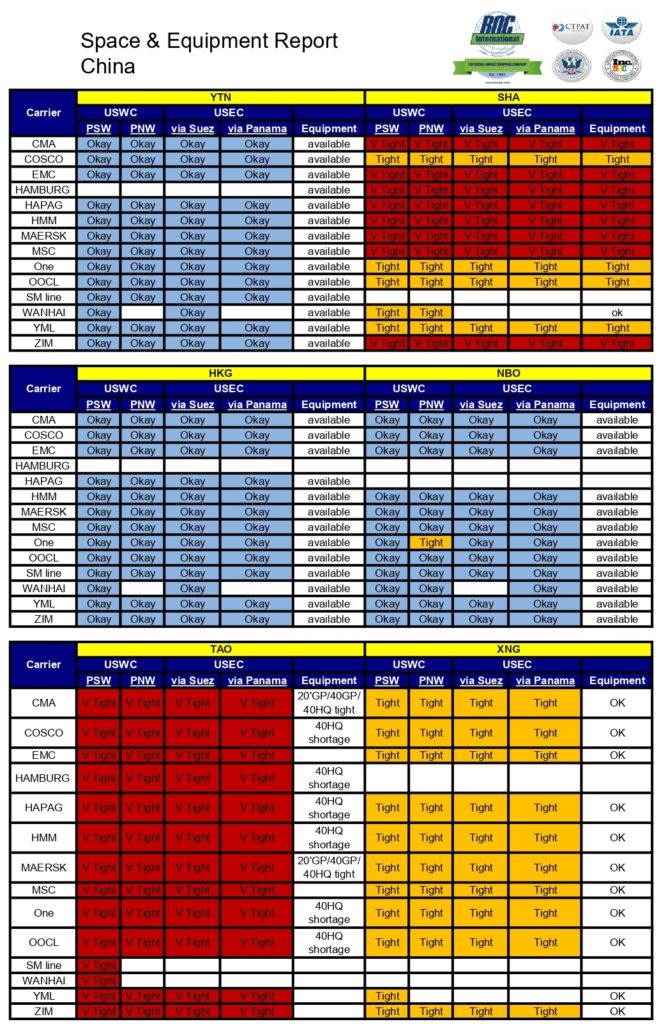

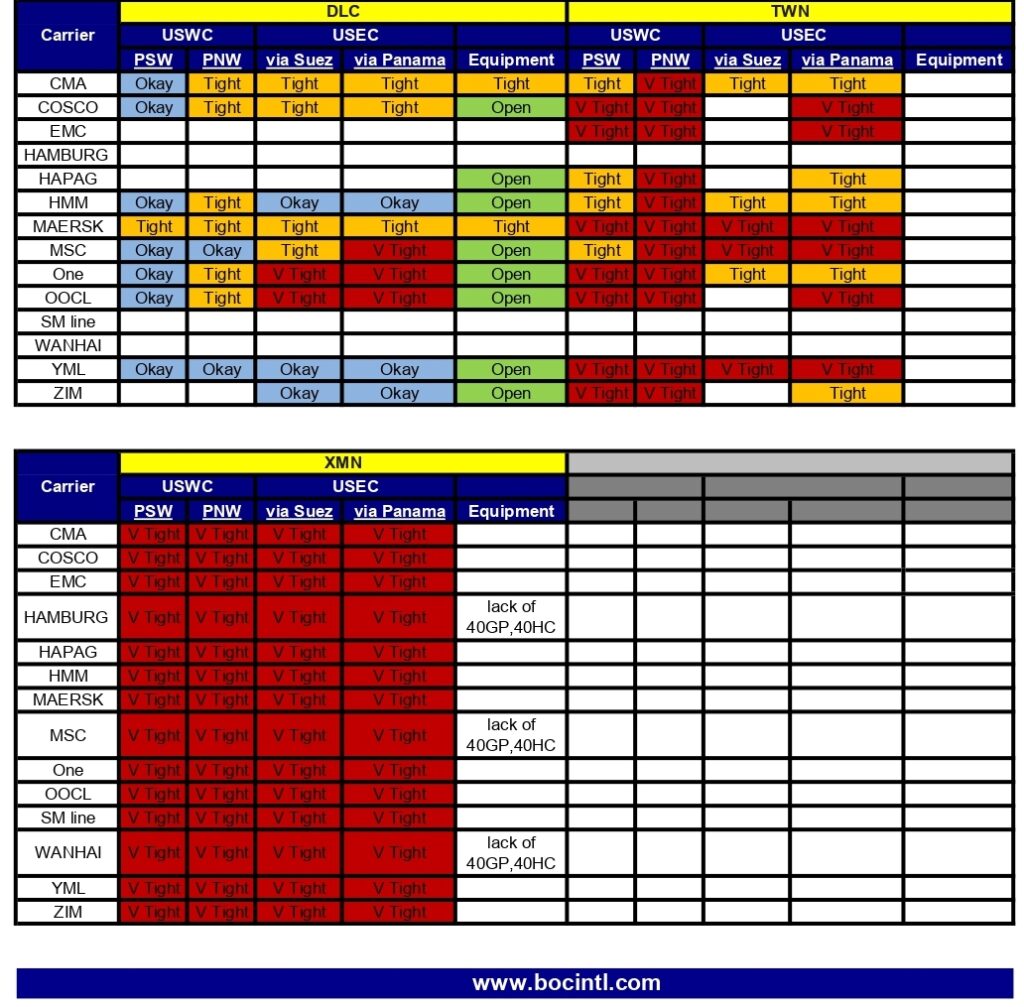

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

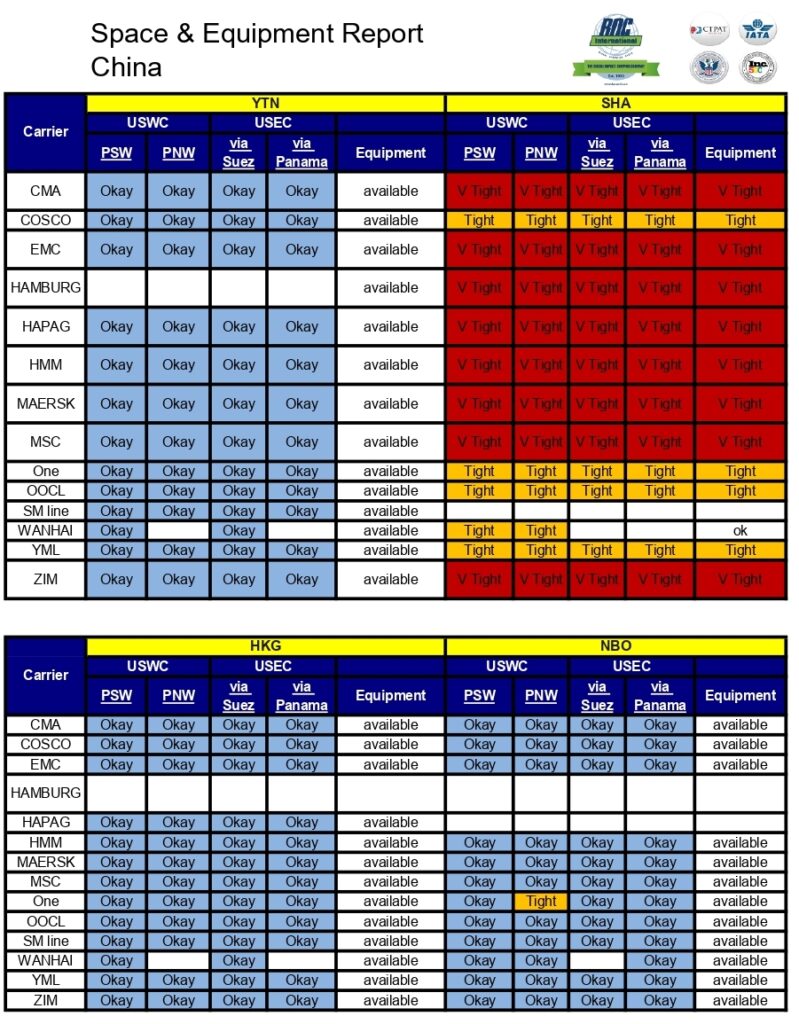

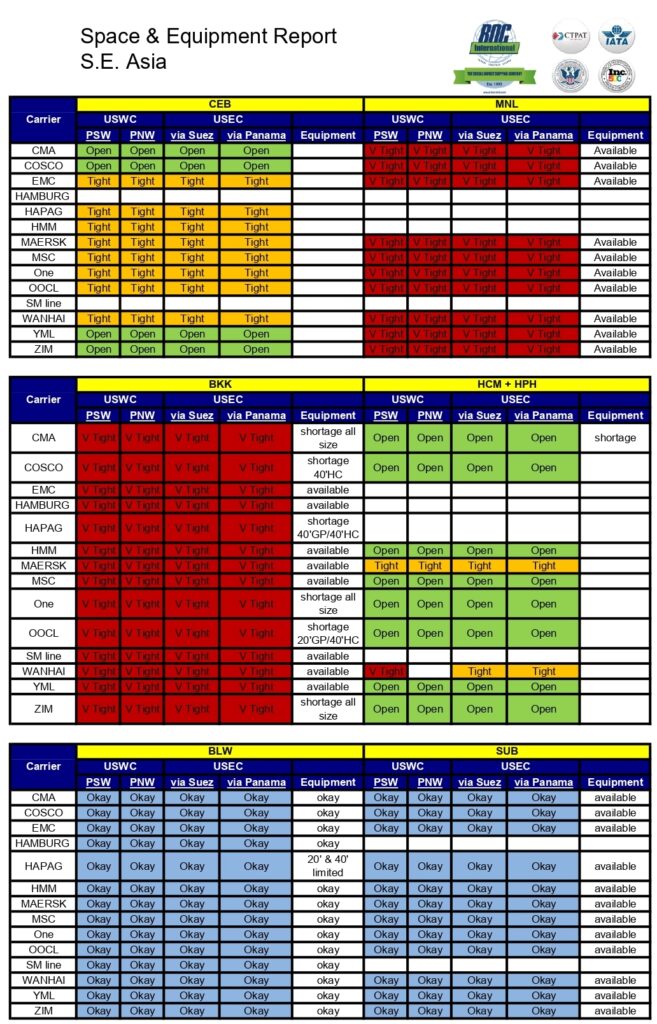

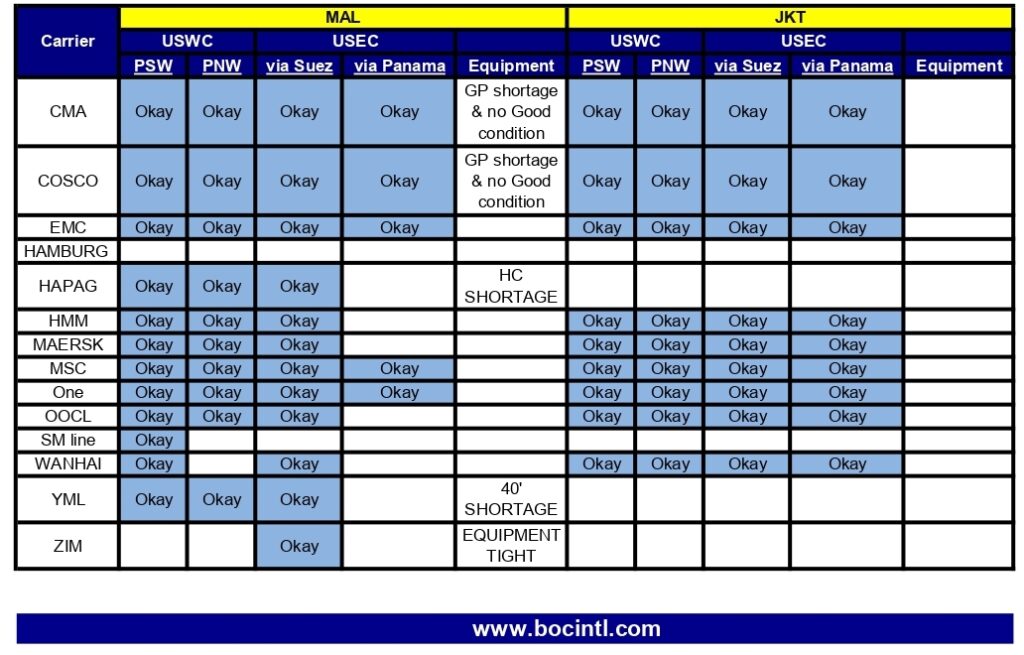

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Increase in Tariffs on India Products Imported into the US and Reminder on Prior Executive Order

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

(b) Accordingly, and as consistent with applicable law, articles of India imported into the customs territory of the United States shall be subject to an additional ad valorem rate of duty of 25 percent. Subject to section 3 of this order, this rate of duty shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 21 days after the date of this order, except for goods that (1) were loaded onto a vessel at the port of loading and in transit on the final mode of transit prior to entry into the United States before 12:01 a.m. eastern daylight time 21 days after the date of this order; and (2) are entered for consumption, or withdrawn from warehouse for consumption, before 12:01 a.m. eastern daylight time on September 17, 2025.

Please read the full Executive Order to see full details, exceptions and other important information.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

REMINDER: Executive Order 14326, “Further Modifying the Reciprocal Tariff Rates” dated July 31, 2025, effective date (after 7 days) starts today, August 7, 12:01 AM. However, note the dates of shipments exempted, below:

Excerpted from that EO –

Sec. 2. Tariff Modifications. (a) The Harmonized Tariff Schedule of the United States (HTSUS) shall be modified as provided in Annex II to this order. These modifications shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order, except that goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time 7 days after the date of this order, and entered for consumption, or withdrawn from warehouse for consumption, before 12:01 a.m. eastern daylight time on October 5, 2025, shall not be subject to such additional duty and shall instead remain subject to the additional ad valorem duties previously imposed in Executive Order 14257, as amended.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

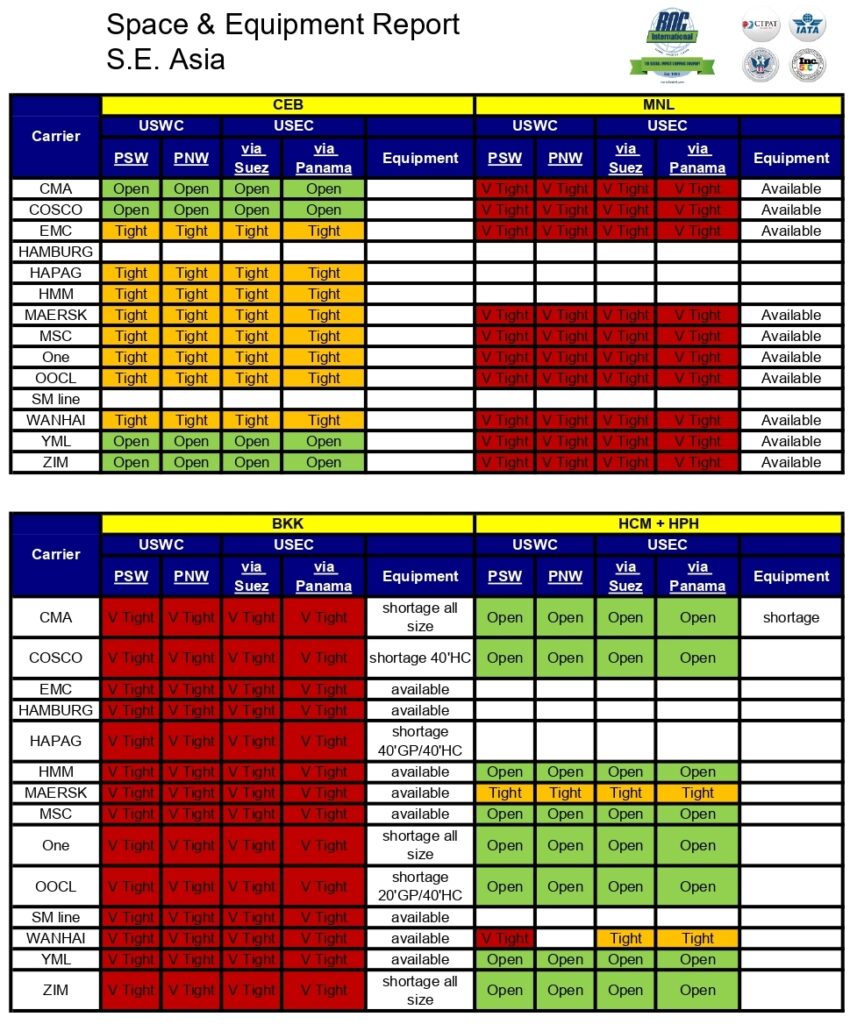

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Three Executive Orders Modifying Reciprocal Tariffs,

Increasing Canada’s Tariff Rate and Increasing Brazil Tariffs

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Below, please find the links to three executive orders, as well as brief summaries of some of the important points. In order to completely understand the orders, please read them fully. Below are only some of the key highlights.

Modifying Reciprocal Tariffs – (note the dates and exceptions for goods in transit, below)

Sec. 2. Tariff Modifications.

(a) The Harmonized Tariff Schedule of the United States (HTSUS) shall be modified as provided in Annex II to this order (see actual EO for Annex II). These modifications shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order, except that goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time 7 days after the date of this order, AND entered for consumption, or withdrawn from warehouse for consumption, before 12:01 a.m. eastern daylight time on October 5, 2025, shall not be subject to such additional duty and shall instead remain subject to the additional ad valorem duties previously imposed in Executive Order 14257, as amended.

(b) Certain foreign trading partners identified in Annex I to this order have agreed to, or are on the verge of concluding, meaningful trade and security agreements with the United States. Goods of those trading partners will remain subject to the additional ad valorem duties provided in Annex I to this order until such time as those agreements are concluded, and I issue subsequent orders memorializing the terms of those agreements.

(c) For a good of the European Union with a Column 1 Duty Rate that is less than 15 percent, the sum of its Column 1 Duty Rate and the additional ad valorem rate of duty pursuant to this order shall be 15 percent. For a good of the European Union with a Column 1 Duty Rate that is at least 15 percent, the additional ad valorem rate of duty pursuant to this order shall be zero.

(d) Goods of any foreign trading partner that is not listed in Annex I to this order will be subject to an additional ad valorem rate of duty of 10 percent pursuant to the terms of Executive Order 14257, as amended, unless otherwise expressly provided. This rate shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order.

(e) The HTSUS shall also be modified by continuing to suspend headings 9903.01.43 through 9903.01.62 and 9903.01.64 through 9903.01.76, and subdivisions (v)(xiii)(1)–(9) and (11)‑(57) of U.S. note 2 to subchapter III of chapter 99 of the HTSUS, until the effective date of the modifications provided in Annex II to this order. Upon the effective date of the modifications provided in Annex II to this order, to facilitate implementation of the rates of duty provided in Annex I to this order, headings 9903.01.43 through 9903.01.62 and 9903.01.64 through 9903.01.76, which are organized by rate of duty, and subdivisions (v)(xiii) (1)-(9) and (11)-(57) of U.S. note 2 to subchapter III of chapter 99 of the HTSUS shall be terminated as to future entries and replaced by the new trading partner-specific headings provided in Annex II to this order.

Amendment to Canada Tariffs – ((increase from 25% to 35%) (note the date below)

Sec. 2. Implementation. (a) All articles that are subject to the additional ad valorem rate of duty of 25 percent under Executive Order 14193, as amended, shall instead be subject to an additional ad valorem rate of duty of 35 percent. Accordingly, the Harmonized Tariff Schedule of the United States (HTSUS) shall be modified as provided in the Annex to this order.

(b) The changes set forth herein shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on August 1, 2025.

Annex

Effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on August 1, 2025, subchapter III of chapter 99 of the Harmonized Tariff Schedule of the United States (HTSUS) is modified as follows:

(a) Heading 9903.01.10 of the HTSUS is amended by deleting “25%” each place that it appears and by inserting “35%” in lieu thereof; and

(b) Subdivision (j) of U.S. note 2 to subchapter III of chapter 99 of the HTSUS is amended by:

(i) deleting “25%” and inserting “35%” in lieu thereof, and

(ii) deleting “described in headings 9903.01.11, 9903.01.12, 9903.01.13, 9903.01.14, and 9903.01.15” and inserting “described in headings 9903.01.11, 9903.01.12, 9903.01.13, 9903.01.14, 9903.01.15 and 9903.01.16” in lieu thereof.

Amendment to Brazil Tariffs – ((increase from 25% to 35%) (note the dates and exceptions for goods in transit, below)

https://www.whitehouse.gov/presidential-actions/2025/07/addressing-threats-to-the-us

Sec. 2. Tariff Modifications.

(a) Articles of Brazil imported into the customs territory of the United States shall be, consistent with law, subject to an additional ad valorem rate of duty of 40 percent. This rate of duty shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order, except those goods encompassed by 50 U.S.C. 1702(b) or set forth in Annex I to this order, and except for goods that (1) were loaded onto a vessel at the port of loading and in transit on the final mode of transit prior to entry into the United States, before 12:01 a.m. eastern daylight time 7 days after the date of this order; and (2) are entered for consumption, or withdrawn from warehouse for consumption before 12:01 a.m. eastern daylight time on October 5, 2025.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

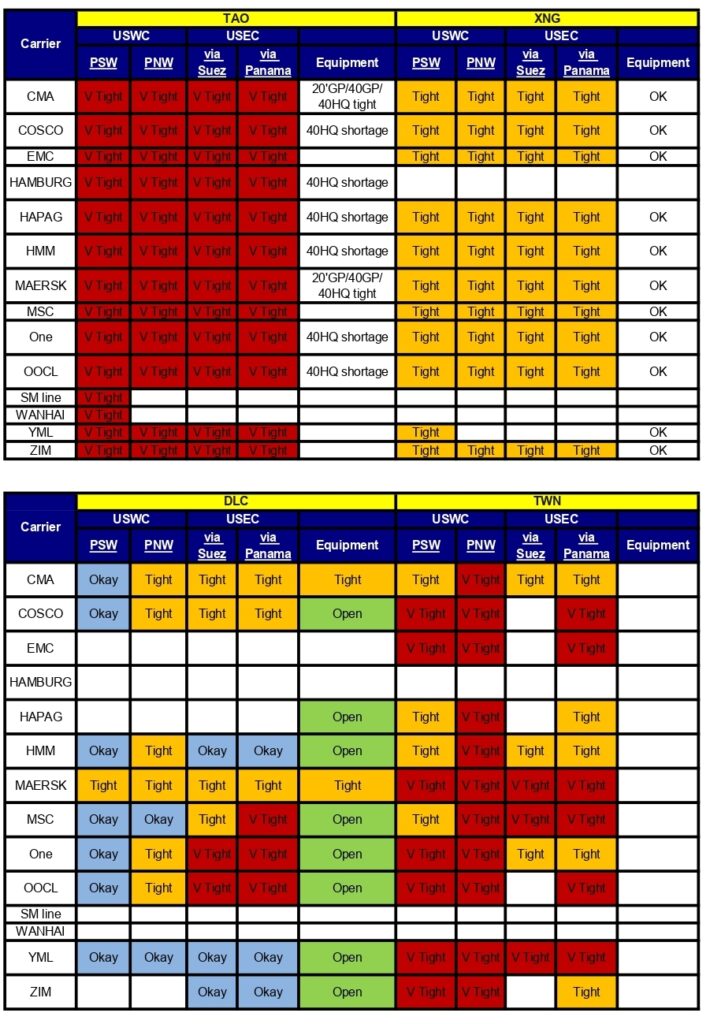

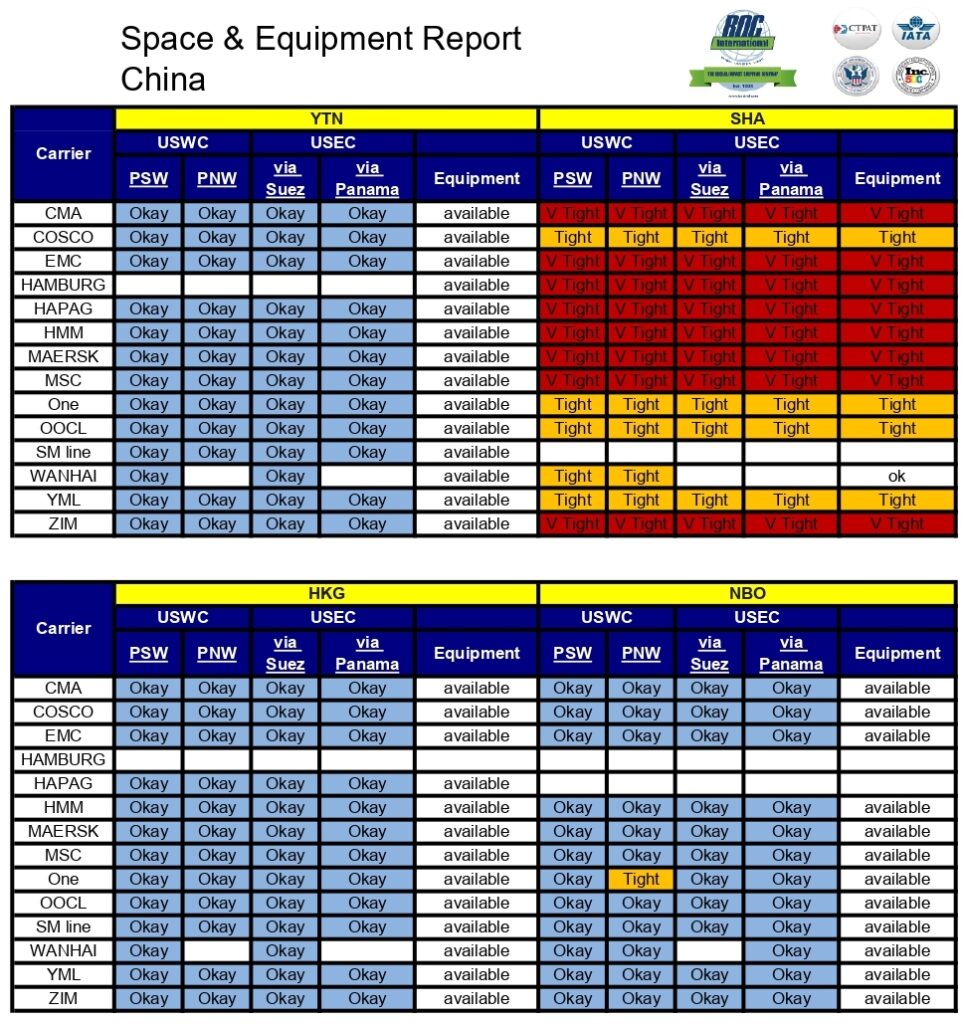

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

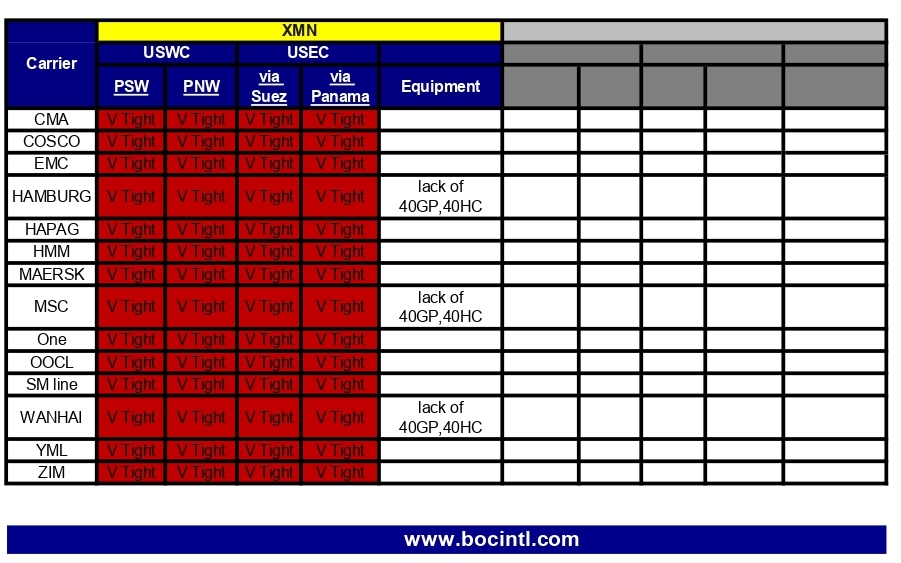

Please find our newest Space and Equipment report, below.

Please note: regardless of the status showing on the report, please reach out to your BOC Representative to discuss existing status. Space availability changes daily, even multiple times per day. This report is just a general guideline. We will always do everything we can to help you move your freight.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..